(Finance) – Negative day for Piazza Affari, which closed the trading down, together with the other Eurolistini. The sell-off that has been affecting the US markets in the last two days is weighing, with today’s data on the growth of jobs in the US that could push the FED towards an even more restrictive intervention. Meanwhile, the general tension on the markets also affects the spreadwith the differential between Italian and German ten-year yields rising above 200 points, the highest since May 2020.

“Data from the entire global economy indicates a slowdown in activity, as real incomes are squeezed by higher prices, financial conditions begin to tighten and China is struggling to implement its zero-Covid policy,” said Mark Dowding. , CIO of BlueBay – However, government bond yields remain far more sensitive to inflation than growth for the time being, in the belief that central bankers will be forced to act to preserve price stability as a general imperative for the foreseeable future“.

L’Euro / US dollar trading continues with a fractional gain of 0.34%. Slight increase forgold, which shows an increase of 0.52%. Heavy oil purchases (Light Sweet Crude Oil), showing a gain of 2.24%.

On parity it spreadwhich remains at +199 basis points, with the yield on the ten-year BTP standing at 3.14%.

Among the main European stock exchanges significant losses for Frankfurtdown 1.64%, in apnea Londonwhich retreats by 1.54%, and thud of Pariswhich shows a fall of 1.73%.

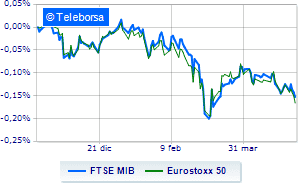

Minus sign in closing for the Milanese list, in a session characterized by large sales, with the FTSE MIB which accuses a decrease of 1.20%, continuing on the downward trend represented by three consecutive drops, in existence since last Wednesday; along the same lines, the FTSE Italia All-Share it lost 1.20%, ending the session at 25,637 points.

The FTSE Italia Mid Cap (-1.56%); on the same trend, the very bad FTSE Italia Star (-2.49%).

From the closing figures for Milan, the turnover in today’s session was equal to 2.15 billion euro, down (-10.96%), compared to the previous 2.42 billion; while the volumes traded went from 0.72 billion shares of the previous session to today’s 0.59 billion.

Between best Italian stocks large cap, excellent performance for Stellantiswhich registers an increase of 3.25%.

Toned Iveco Group which shows a nice advantage of 1.13%.

In light Saipemwith a large increase of 1.07%.

Small steps forward for ENIwhich marks a marginal increase of 0.70%.

The strongest declines, on the other hand, occurred on Campariwhich closed the session at -6.12%.

Letter on Finecowhich records a significant decline of 4.67%.

Goes down Monclerwith a decline of 4.22%.

Sales on Unicreditwhich recorded a decline of 4.08%.

Among the protagonists of the FTSE MidCap, Saint Lawrence (+ 2.32%), Autogrill (+ 2.23%), Anima Holding (+ 0.97%) e Brembo (+ 0.82%).

Stronger sales, on the other hand, fell on Carel Industrieswhich ended trading at -6.78%.

Collapses Pharmanutrawith a decrease of 5.33%.

Sales hands on Replywhich suffers a decrease of 5.16%.

Negative sitting for MPS Bankwhich shows a loss of 5.05%.

Between macroeconomic quantities most important:

Friday 06/05/2022

08:00 Germany: Industrial production, monthly (expected -1%; previous 0.1%)

08:45 France: Employment, quarterly (previous 0.4%)

10:00 Italy: Retail sales, monthly (previous 0.7%)

10:00 Italy: Retail sales, annual (previous 4.6%)

14:30 USA: Employment change (expected 391K units; previous 428K units).