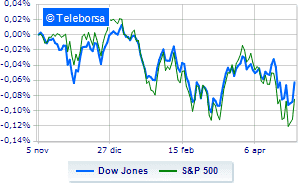

(Finance) – Slight increase for the Wall Street Stock Exchangeafter several hours in negative territory, with the Dow Jones which rises by 0.40% to 33,260 points, consolidating the series of three consecutive increases, started last Monday; on the same line, theS & P-500 it makes a small jump of 0.29%, reaching 4,188 points. Consolidate eve levels on Nasdaq 100 (+ 0.04%); slightly positiveS&P 100 (+ 0.4%). Leading the markets today is the Federal Reserve’s FOMC decision on rate hikes.

Utilities (+ 1.30%), power (+ 1.05%) e consumer goods for the office (+ 0.72%) in good light on the S&P 500 list. At the bottom of the ranking, significant falls are evident in the sector secondary consumer goods, which reports a decrease of -0.77%. Meanwhile, on the macroeconomic front, i ADP data on employees in the US private sector they fell short of expectations, with an increase of 247,000 units in April against the estimated +395,000.

Between protagonists of the Dow Jones, Walgreens Boots Alliance (+ 2.08%), 3M (+ 2.00%), Honeywell International (+ 1.88%) e IBM (+ 1.80%).

The worst performances, on the other hand, are recorded on Nikewhich gets -1.24%.

Small loss for Boeingwhich trades with a -0.68%.

He hesitates United Healthwhich yields 0.64%.

Between best performers of the Nasdaq 100, Starbucks (+ 8.09%), Advanced Micro Devices (+ 3.80%), Constellation Energy (+ 3.19%) e Charter Communications (+ 2.93%).

The strongest sales, on the other hand, show up on Skyworks Solutionswhich continues trading at -9.71%.

Letter on Idexx Laboratorieswhich records a significant decline of 7.32%.

Goes down Verisk Analyticswith a fall of 6.27%.

Collapses Crowdstrike Holdingswith a decrease of 5.28%.

Between macroeconomic variables most important in the North American markets:

Wednesday 04/05/2022

14:15 USA: ADP employed (expected 395K units; previous 479K units)

14:30 USA: Balance of trade (expected -107 B $; previously -89.8 B $)

15:45 USA: PMI services (expected 54.7 points; preceding 58 points)

15:45 USA: Composite PMI (expected 55.1 points; preceding 57.7 points)

4:00 pm USA: ISM non-manufacturing (58.5 points expected; previously 58.3 points).