(Finance) – Webuild announced that endedon April 28, 2022, the share buyback program launched on January 27, 2022.

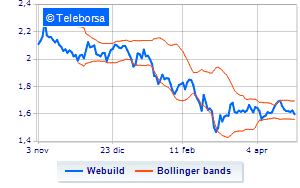

As part of this program, from January 27, 2022 until April 28, 2022, a total of 9,025,137 ordinary treasury shares were purchased at the average price of 1.6726 euro per share, for an equivalent value of 15,031,559.19 euro. Furthermore CIR has communicated that, starting from 29 April 2022has been initiated into the own share buyback program as part of the purchase authorization approved by the Shareholders’ Meeting of 28 April 2022.

The Program, which can be implemented within 18 months from the date of the shareholders’ resolution and, therefore, by October 28, 2022, has as its objectives the medium and long-term investment or in any case in order to seize market opportunities also through the purchase. and the resale of the shares whenever it is appropriate and to have a portfolio of treasury shares available in the context of any extraordinary finance and / or incentive transactions and / or for other uses deemed to be of financial, managerial and / or strategic interest for the Company.

In light of the above, Webuild announced that it had purchased, in the week from 25 to 29 April 2022 inclusive, a total of 490,495 ordinary treasury shares at the average price of € 1.6235 per share, for a value of € 798,272.18, in the ” scope of the purchase authorization approved by the Shareholders ‘Meeting of April 30, 2021, for transactions carried out up to and including April 28, 2022, and by the Shareholders’ Meeting of April 28, 2022, for transactions carried out on April 29, 2022.

Following the purchases made, Webuild holds a total of 10,391,970 ordinary treasury shares as of April 29, 2022, representing 1.039% of the ordinary share capital.

On the Milanese price list, today, closing in red for the company specializing in the construction of large complex workswhich ended the session with a decrease of 1.72%.