(Finance) – The Wall Street stock market opens lower in the last session of April, preparing to close a monthly balance in the red. Investors are moving close between the impending rate hikethe rush of inflation and the consequences of war in Ukraine. In the meantime, the quarterly season with the accounts of Amazon and Apple which disappointed the operators.

On the macroeconomic front, inflation continues to rise: the measure preferred by the Federal Reserveto calculate it, or the PCE (personal consumption expenditures, price index) figure, grew in March, recording the highest figure since 1982. The cost of labor, as well as personal income and expenses for consumption.

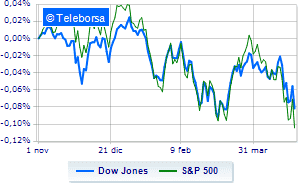

Among the US indices, the Dow Jones the session continues with a slight decrease of 0.37%; on the same line, theS & P-500, which slips to 4,251 points. Downhill the Nasdaq 100 (-1.06%); as well, negative theS&P 100 (-0.96%).

Negative trend in the States on all sectors of the S&P 500. In the list, the sectors secondary consumer goods (-2.69%), sanitary (-1.29%) e utilities (-1.21%) are among the best sellers.

Among the best Blue Chips of the Dow Jones, Honeywell International (+ 4.89%), 3M (+ 0.70%) e Merck (+ 0.54%).

The strongest sales, on the other hand, show up on Intelwhich continues trading at -5.59%.

Prey of the sellers Verizon Communicationwith a decrease of 1.80%.

Sales focus on Amgenwhich suffers a decrease of 1.54%.

Sales on Johnson & Johnsonwhich recorded a decrease of 1.49%.

Between best performers of the Nasdaq 100, Pinduoduo Inc Spon Each Rep (+ 14.99%), Baidu (+ 10.46%), JD.com (+ 8.43%) e NetEase (+ 7.35%).

The strongest falls, on the other hand, occur on Verisignwhich continues the session with -11.24%.

Letter on Amazonwhich records an important decline of 11.11%.

Goes down Atlassianwith a fall of 6.38%.

Collapses Intelwith a decrease of 5.59%.

Between macroeconomic quantities most important of the US markets:

Friday 29/04/2022

14:30 USA: Labor cost index, quarterly (expected 1.1%; previous 1%)

14:30 USA: Personal expenses, monthly (expected 0.7%; previous 0.6%)

14:30 USA: Personal income, monthly (expected 0.4%; previous 0.7%)

15:45 USA: PMI Chicago (expected 62 points; preceding 62.9 points)

4:00 pm USA: University of Michigan Consumer Confidence (expected 65.7 points; preceded 59.4 points).