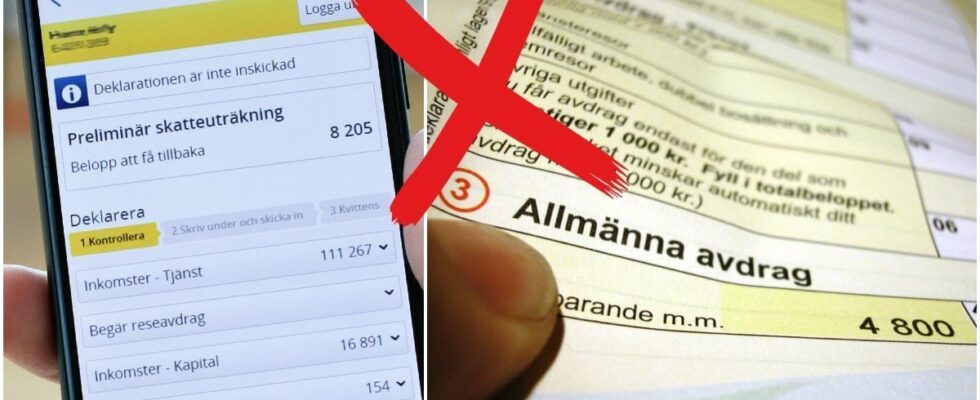

It will be time to approve the declaration if you received it in your digital mailbox – at least if you want the money before Easter.

In 2025, there are some news in the declaration, especially when it comes to what deductions you can make. One of the changes compared to last year is the grid and root deduction, which during the second half of 2024 was increased to a total of SEK 150,000. The declaration 2025 shows if you have used the deduction.

From 1 January 2025, the regular level of SEK 75,000 applies.

The Swedish Tax Agency’s declaration expert, Emelie Köhnhave previously told News24 About the changed deductions and amounts she wants to lift, which will be relevant in the declaration next year, for the income year 2025:

A popular deduction that many Swedes take in the declarations year after year is the travel deduction.

On January 1, 2023, the new travel deduction that the government instituted began to apply. This means that, in order to be qualified for the deduction, you must have travel expenses exceeding SEK 11,000 per year. In addition, the distance you travel to and from work is required to be at least five kilometers in size.

The big question for many who intend to use the deduction is whether the Swedish Tax Agency can deny it?

To find out, News24 has once again contacted the Swedish Tax Agency’s declaration expert, Emelie Köhn. In an email, she reports that if the rules are not met when you report the deduction in the declaration, it can be denied.

“If the rules are not met, for example if you do not make a time gain with at least 2 hours a day compared to traveling collectively to work. If you meet the requirements, you are entitled to deductions, what we could deny then is if you estimate the amount that you can deduct deductions with errors. Or if you could not show that you could have the costs.”

What is important to consider if to make the travel deduction?

“Save receipts so you can show your costs for us if we need to see them to assess if you are entitled to deductions. Feel free to use our calculation aid on taxverket.se to see if you are entitled to deductions and if so with how much,” Köhn writes to News24.