No sooner had the sun pointed out that the sky suddenly darkened above the Bordeaux vines. On March 13, the temperate tenant of the White House threatened to establish 200 % customs duties on wines and other European alcohols, retaluating the taxation envisaged by Brussels of American products such as whiskey. The tricolor winegrowers, caught up in a quarrel that initially concerned the metals, are on the alert. America is their first international outlet, or around 15 % of exported volumes.

But on the other side of the Atlantic, the time is not at the party either. Donald Trump said that these measures “would favor the wine and champagne sector in the United States” … reality is in fact more complex. Ted Lemon, founder with his wife, Heidi, from the Californian Domaine Littorai, is not fooled. “We enter a world of enormous unknowns, and the unknown is the enemy of investment,” he argues in a neat French, inherited from a few years in Burgundy. He who planned to buy a new property and build a underground cellar put his projects on a break. Especially since this lack of visibility is added to precarious economic health of the sector.

In the United States, the wine market is going through a difficult period.

© / Lucile Laurent / L’Express

No substitution effect

The bottles of this producer of Pinot Noir and Chardonnay are displayed, on average, at 90 dollars at retail. In general, Californian wines are at rather high prices – due to heavier production costs and a market positioning aimed at relatively easy clientele – while their European counterparts cover a larger range. Admittedly, part of the Made in California wines could benefit from the increase in the price of their competitors. But David Harris, director of research on the alcoholic drinks market in GlobalData, hastens to qualify this first intuition: “Even with such an surcharge, a bottle imported from Pinot Grigio, which previously cost $ 5, will remain cheaper than Californian wine at 25 dollars.”

Beyond the price, preferences are well rooted. “If people want a Sancerre, they will not buy a Californian white Sauvignon instead,” explains the expert Jon Bonné, author of The New California Wine. They will simply pay for their Sancerre more … or will drink a cocktail. Conversely, Californian wine enthusiasts already drink Californian wine. There are very few overlaps between these consumers. “Difficult, thus, to bet on a substitution effect.

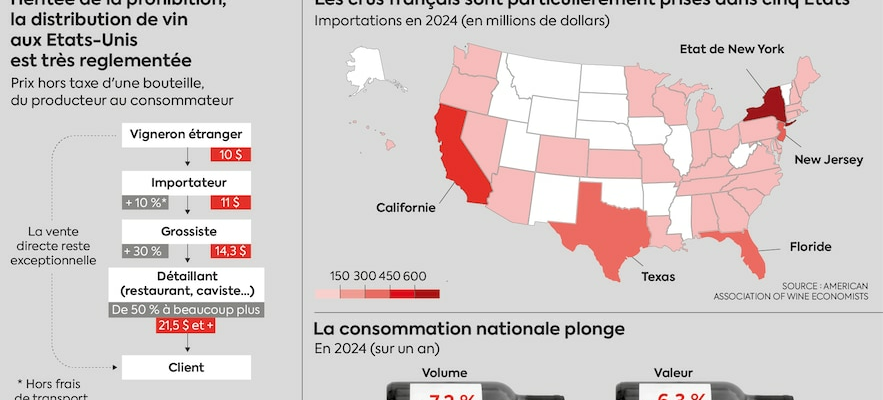

The collateral consequences of this trade war are also disturbing. Since the end of prohibition, the United States has applied a three-step alcohol sales system (three–tier system) : producers go through distributors, who deliver the goods to retailers (wine merchants, restaurateurs, etc.), before it is sold to consumers. Everyone takes a margin in passing, inflating the final note. It is therefore enough for an increase in prices to import for the whole toast ecosystem. According to US Wine Trade Alliance estimates, for each dollar spent to import Europe wine, US companies in the sector earn $ 4.50. “These customs duties will only harm the entire sector, including winegrowers, distributors, retailers and millions of people who work throughout the wine supply chain,” argues a spokesperson for the Wine Institute, the Californian wine lobby. Ted Lemon confirms: “Distributors who sell our products across the country also offer an important offer of European wines. If they suffer – and they find it difficult to pay ourselves – we will automatically suffer.” Even the national winegrowers, who hoped to gain competitiveness, believe that this measure is too extreme, points Mike Veseth, author of Wine Wars. “In the end, the global narrowing of the market will neutralize all the advantages they could draw from this measure,” concludes this specialist.

Some are already considering the possibility of bypassing these future customs barriers. “We could imagine that Europe exports loose wine, which will be labeled in third countries, before being re-exported to the United States. This is what Australia had done when China had taxed its wine [NDLR : en 2020]”, Recalls Jean-Marie Cardebat, professor at the University of Bordeaux and specialist in wine economics.

Fear of reprisals

Between Europe and the Trump administration, this showdown around wine has a previous one. Already in 2019, customs duties of 25 % had been applied to bottles in several countries. For a profit that remains to be proven on the American side. Chris Howell, boss of the Cain vineyard in Napa Valley, did not see a positive impact on his business. “The restaurants that provided each other with us have not placed more orders. In fact, we do not pretend to replace European wine, we can only continue to be inspired,” he admits.

Since his return to the White House, the Republican President has decidedly gone back to the sector. In Canada, supermarkets withdrew the Californian wines from their shelves, following the commercial dispute between the two countries. The winegrowers turned to export, like Ted Lemon, fear that other countries adopt reprisal measures. Producers are also very dependent on bottles, presses and other traffic jams from Europe. “For many of these elements, we do not have national production,” points out Chris Howell, worried about a possible taxation.

Existential crisis

Politics is not the only wound to fall on the American vineyard. Since he settled down in California, fifteen years ago, Dan Petroski has only experienced extreme climatic events. “Between forest fires, drought and torrential rains, each year is a new challenge,” notes this producer of white wine, head of the Massican vineyard. Repeated fires are the bane of the winegrowers. The legendary Newton Vineyard, which belonged to LVMH, was ravaged by the flames in 2020. After a hope of reconstruction, the domain finally announced its final closure in February. If the vines are not destroyed by fire, smoke can easily degrade them. It is deposited and embeds in the grapes, altering the taste of wine. From now on, some insurers refuse to cover stocks. Dan Petroski saw the assurance of his cellar removed by a company following fires of 2020, while one Another has increased its premiums.

Faced with warming, the most persevering winemakers test innovative irrigation methods when others turn to grape varieties more resistant to droughts. But some give up. In 2024, 4 % of California vineyards closed, according to GlobalData. “Apart from the biggest brands, most wine producers consider that they are going through an existential crisis. There will probably be more and more vineyards sold in the years to come,” said David Harris.

The sector is finally faced with the decline of consumption, against the backdrop of new practices, such as the Dry January – A month of sobriety – and aware of the effects of alcohol on health. Some professionals blame the legalization of cannabis, which encroaches on the market for young people in search of happy sensations. “It is hard to assess the overall magnitude of the withdrawal, sighs Ted Lemon. One thing is certain, the small areas of luxury wine cannot afford to produce cheap wine to attract consumer customers.” In the absence of a sufficient request, as in France, the vines of vines are multiplying in the Californian valleys. Hello damage …

.