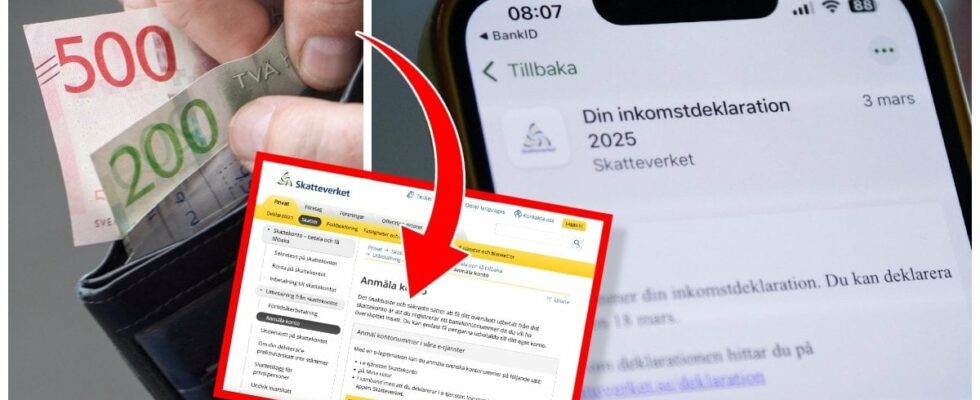

600,000 people – consciously or unconsciously – have not specified an important task to the Swedish Tax Agency – something that can affect how and when you get your possible tax refund.

Between March 3 and 7, the Swedish Tax Agency sent out the declaration digitally to those who, by March 2, provided a digital mailbox. Ten days later, on March 17, the authority began to distribute the declaration in paper form – a mailing that will last until April 15.

And already when the declaration opened, March 18, many declared directly.

Read more: List: Here are all deductions you can make in the Declaration 2025

In fact, as many as 1,422,000 people approved the declaration, without changes and additions, during the first day.

-Everyone with e-identification has been able to log in and look at their declaration from March 7 this year and have had a week to go through the declaration. We have seen an increased interest in declaring earlier for several years, which has contributed to a record number of declarations on the first day, says Jan Janowskideclaration expert at the Swedish Tax Agency, in a press release.

Don’t miss: Everything About Remaining Tax 2025: Interest and last day to pay

Read more: Declaration 2025: Are you examined by the Swedish Tax Agency this year?

600,000 have not reported bank account to the Swedish Tax Agency

At the same time, tells us Johan Schaumanat the Swedish Tax Agency’s customer and communications department, for News24 that there are just over 600,000 people who have not reported a bank account to the authority.

– A group that may have failed to register a bank account may be people aged 16 or 17 who have worked for the first time and who have never declared before and therefore had no reason to report a bank account before.

Schauman also points out how some people, who have recently moved to Sweden and started working, may also be among those who have not reported an account.

– Then it may be individuals who have never received a refund. They have always sold shares, have no loans with interest or similar.

Don’t miss: Luxury trap-Magdalena: Don’t do this with the tax refund

Can delay your payment of tax refund 2025

Johan Schauman recommends that you register his bank account already in connection with declaring – something that 92 percent did digitally last year.

To the elderly who declare on paper, and who want to register their bank account to the Swedish Tax Agency, but do not know how will Schauman with a advice:

– Take the help of some relatives to read on the web about how to most easily do it.

What happens if you have not registered a bank account when the tax refund is to be paid out?

– Traditionally, we have mailing where you can redeem the payment. But there we have an amount limit.

– However, it is not usually so popular, because it costs money to redeem them, which many people are disturbed. Then it also takes time for us to administer such payouts, so you also have to wait much longer to get your tax refund. So I would, whether you usually get a tax refund, advise everyone to register a bank account.

Read more: News Today – Current news from Sweden and the world

Don’t miss: Latest news – take part in what is happening right now