A small unknown tax case must be filled with many French people.

This is one of the small unknown boxes of the income declaration. If taxes make it possible to deduce many charges supported throughout the year, some are better known than others. Childcare costs, home service or mileage costs are among the most used devices by taxpayers. Among the most discreet, one of them concerns certain banking costs.

Expenses incurred with the bank can be deducted from the amount of your taxes and approximately 5 million French people can take advantage of it. However, the calculations must be done well. Not everyone has a financial interest in doing so, especially since it does not concern all costs forced by banking establishments.

With an average of more than 200 euros per year, on average expenses related to banking costs weigh heavy with many households. The cost of account holding, overdraft or bank card are the main reasons. Some customers are taking other expenses, linked to the management of their savings.

This is particularly the case for holders of a equity savings plan. These are the people who have invested in buying actions from a business. 5,236,241 French were concerned at the end of 2023, according to the latest figures from the Banque de France.

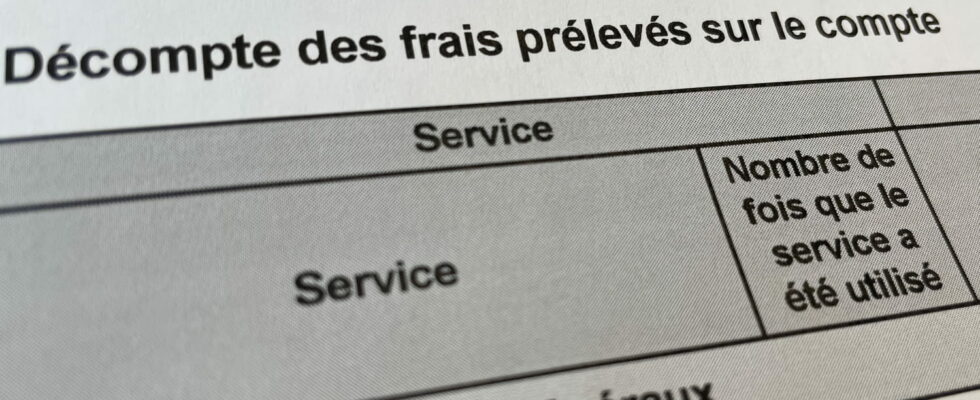

To keep these actions (called “titles”), customers pay the bank. These are the “childcare costs”. They can rise up to 0.4% of the value held. For example, a customer holding for € 3000 in shares will pay, as much as possible, € 120 per year. However, these costs can be deducted from taxes. To do this, you must register them in box 2CA. The tax reduction is calculated according to the tax bracket.

To use our example: the taxpayer declares € 120 in tax costs. If it is imposed at 11%, it will benefit from a tax reduction of € 13.20 (11% of € 120).

Only people are imposed in the 0 or 11% tranche have an interest in using this mechanism for their PEA. Be careful however: to benefit from this system, you must also think of checking the 2op to confirm to the tax authorities that you wish to be imposed on the income tax scale.

For those who are in the slice at 30% and above, it is important not to fill box 2CA, nor check box 2op. Automatic tax at 12.8% will then be applied to the gains generated by your PEA and will save you taxes.