MCKINSEY. In mid-March, a Senate report sparked the “McKinsey affair”, named after a private consulting firm paid by the state, but which would not pay any tax. An investigation has been opened. The summary of the case.

The soufflé quickly subsided. But the case has not been forgotten. In mid-March, the McKinsey affair came to light in the home stretch of the campaign for the first round of the presidential election, splashing Emmanuel Macron and the presidential majority. A month after the publication of a Senate report indicating that the State has a growing and almost systematic use of private consulting firms and that one of them, McKinsey in this case, would not pay taxes in France, where is the investigation? After the revelations of the Senate, the National Financial Prosecutor’s Office (PNF) opened a preliminary investigation on March 31 for aggravated laundering of tax fraud.

The investigations are still in progress at the time of the debate between the two rounds of this presidential election, but no search has yet been carried out in the premises of the headquarters of the French branch of the company, located right on the Champs-Elysees. Investigators also suspect actions that may amount to influence peddling. At the same time, the tax authorities are also carrying out investigations to find out the exact tax situation of McKinsey. Bruno Le Maire, Minister of the Economy, wanted to be categorical on April 7: “McKinsey will pay all they owe as tax to the French public treasury.” For its part, McKinsey defended itself, in a press release published the day before: “McKinsey reaffirms that the firm respects the French tax and social rules which apply to it. The tax approach applied by McKinsey is similar in the countries where it is This approach has been present and constant for years.This approach complies with the guiding principles of the OECD, and has been shared with the French tax authorities.

What is McKinsey France?

McKinsey & Company is a company founded in 1926 in the United States and whose mission is to provide strategy advice to private companies as well as to public entities. Present in 65 countries around the world, it is notably based in France. Two offices are open: one in Paris, on the Champs-Elysées, the other in Lyon. In France, the firm has around 600 employees.

What missions has McKinsey carried out for the State?

Under the mandate of Emmanuel Macron, the McKinsey firm was entrusted with several missions. In particular, for two years and with the firm Accenture, he was responsible for evaluating the national health strategy (cost: 1.2 million euros). It was he who was also commissioned to monitor the viability of CAF’s IT solutions as part of the APL reform (3.88 million euros). Above all, from November 2020 to February 2022, McKinsey was in charge of the vaccination campaign with the logistical organization, the implementation of indicators and monitoring tools and the establishment of an action plan for the recall campaign for the 3rd dose of anti-Covid vaccine.

Why is McKinsey at the heart of a controversy?

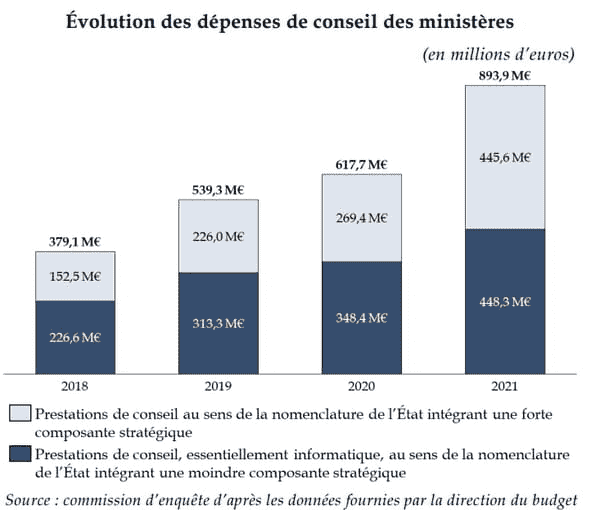

Since March 16, the subject of McKinsey has been regularly mentioned in the media. But two things, summarized under the “McKinsey affair”, are to be distinguished: first, the colossal increase in 2021, by the State, of expenditure to call on consulting firms (see graph below), including McKinsey; then, the conclusion of the Senate report affirming that McKinsey has not paid taxes in France for ten years. It is for this second aspect that the name of the American cabinet mainly emerged from the work of the senators.

Does McKinsey pay its taxes in France?

During their investigative work, the senators interviewed the various stakeholders in the case, including McKinsey. Karim Tadjeddine, associate director of the company in Paris and co-responsible for the “public sector” activity, answered questions from parliamentarians on January 18, 2022. Asked in particular about the French tax situation of the company, he then said : “I say it very clearly: we pay corporate tax in France.” A statement undermined by the investigations of the senators. The latter claim that McKinsey has not paid corporate tax in France for ten years.

Corporation tax is established on the basis of profits made in France during an annual financial year. However, the Senate report only mentions the turnover of the company, ie the total of the sums collected for all the services provided during the year. It does not take expenses into account. It is still difficult to imagine that the company with 329 million euros in turnover in 2020 is in deficit.

The senators therefore have doubts about a possible tax optimization thanks to the “transfer price” with the parent company of McKinsey. These are billings of the latter’s assets with its French subsidiary. These expenses are considered, by French law, as charges, thus leading to a drop in the company’s net income at the end of the year, thus reducing its tax. It is by this means, legal, that McKinsey France would manage not to pay corporate taxes, of which it is here only question.

How much did the state pay McKinsey?

According to a public list of missions entrusted by the State to McKinsey and consulted by Le Monde, the company pocketed at least 27,333,410 euros between 2018 and 2021. At least, because this is a list not limited. In addition, McKinsey was co-assigned in a whole series of contracts, of which only the overall cost is given, without specifying the distribution between the various firms.

For example, in 2018, five firms shared a juicy contract worth 82 million euros for consulting services with the Ministry of the Armed Forces, which, in the event of equal distribution, would have enabled each firm, including McKinsey, to pocket 16.5 million euros.

Without giving a precise figure, Olivier Dussopt, Minister of Public Accounts, said on Wednesday March 30: “The expenditure incurred by the State with McKinsey in 2021 represents 5% in terms of strategy advice.” If “expenses incurred in terms of strategy consulting” include all expenses recorded by senators (893.9 million euros), this corresponds to 44.7 million euros. If this only concerns services with a “strong strategic component”, the amount would be 22.2 million euros, for the year 2021 alone.

Is McKinsey the only consulting firm commissioned by the State?

No. Above all, it is far from being the main thing. The Senate report indicates that between 2018 and 2020, at least 2,070 consulting firms signed contracts with the state. However, 20 of them concentrated… 55% of the contracts awarded. And McKinsey has concentrated only 1% of these contracts. It is Eurogroup which raised the most (10%), ahead of Kior Talent and Capgemini (5% each) or even Ispsos (4%).

Close links between McKinsey and LREM

If McKinsey is one of the consulting firms used by the state, the company was already very close to Emmanuel Macron when he ran for the 2017 presidential election. Officially, the firm only played no role in the victory of the former economy minister. However, the head of state was able to count on the help of several members of the cabinet, such as Karim Tadjeddine, Eric Hazan or Guillaume de Ranieri, as indicated by Le Monde. In addition, two other McKinsey employees had even committed to La République en Marche, including Paul Midy, now general manager of LREM, and Ariane Komorn, in charge of the commitment division until 2021.

A conflict of interest between Laurent Fabius and his son Victor, associate director at McKinsey?

In France, the management of the Covid-19 health crisis has been the subject of much criticism. At the time of the start of vaccination and the establishment of the health pass, the name of the McKinsey firm had already been released. Not without creating controversy. Because a certain Victor Fabius is associate director there; the latter is at the head of one of the French poles of the company. Victor Fabius is none other than the son of Laurent Fabius, President of the Constitutional Council, responsible, at this time, for validating or not the implementation of the vaccination control tool. For some, there was no doubt: the Sages had given the green light to facilitate the affairs of the son Fabius. Questions of conflicts of interest were then raised.

However, it is not the Constitutional Council which made the contract, but the General Directorate of Health. And these were logistical missions. Other firms had also been mandated for other aspects of the deployment of vaccination. In addition, Victor Fabius is in charge of the “Marketing and Sales” division. It is Karim Tadjeddine who is responsible for the “Public sector” activity.

Is the use of consulting firms new?

Again, these consulting firms are nothing new. Both under Emmanuel Macron’s five-year term and during previous terms of office. By way of comparison, under the presidency of Nicolas Sarkozy, for 1000 euros of operating expenses, between 2 and 4 euros were consulting expenses, against around 1.50 euros with François Hollande. An amount that stabilized until 2018 with Emmanuel Macron.