Newly appointed, the new Minister of the Economy arrives in Bercy after announcing bad news to the French.

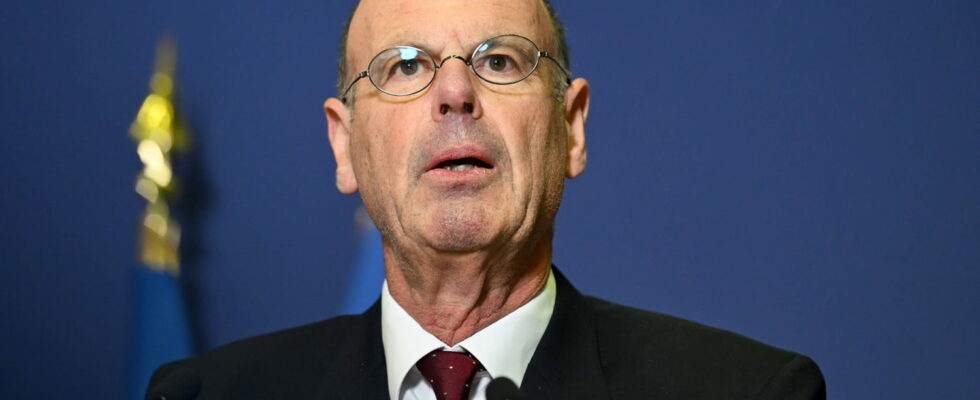

The French don’t know him but should quickly remember his name. Eric Lombard. At 66, he is the new Minister of the Economy. It was he who François Bayrou appointed to Bercy and who he charged with presenting a budget for the coming year. Although the course of action of this unknown person to the general public regarding a possible tax increase is not yet known, he has already made an announcement which will penalize all French people.

This did not go unnoticed by the population but no one suspected that the person who revealed this bad news would become, a few weeks later, the head of State Finance.

Until now, Eric Lombard was head of an administration unknown to the French: the Caisse des Dépôts et des Consignations (CDC). Some people know it because it is, for example, with this structure that the amounts in escrow are deposited as part of a real estate transaction. It is also the one that finances city policy and social housing. But also, and above all, the Caisse des Dépôts is the organization which manages the Livret A, but also the Livret de développement durable et solidaire (LDDS).

As such, Eric Lombard spoke about the future rate of the livret A a few weeks ago. Blocked at 3% since August 2023 and until January 31, 2025, the profitability of the French’s favorite investment will change from January 1er FEBRUARY. And it was the now minister who made the announcement. “The calculation formula (initial, editor’s note) should apply and could arrive in February at a rate around 2.5%,” he declared on Classical Radio on October 31.

The yield on Livret A should therefore decrease. This will be confirmed around January 15. It will be the same for the LDDS, which follows the same evolution as the Livret A. Its rate will be the same and will therefore also drop to around 2.5%.

For example, for a saver who will hold on average €5,000 in their Livret A throughout the year 2025, they will receive €127 in interest with the drop in interest, compared to €150 if the rate is maintained at 3%.