The cost of a home loan is not limited to the interest paid to the bank. You must also take into account the application fees, guarantee and above all, loan insurance. This covers the borrower in the event of a life accident – death, disability, loss of autonomy – by taking charge of the repayment of the loan. It is not mandatory from a regulatory point of view, but in practice, banks require it. It costs on average 0.36% of the capital borrowed, which currently represents around 15% of the total cost of credit. A bill that can be reduced.

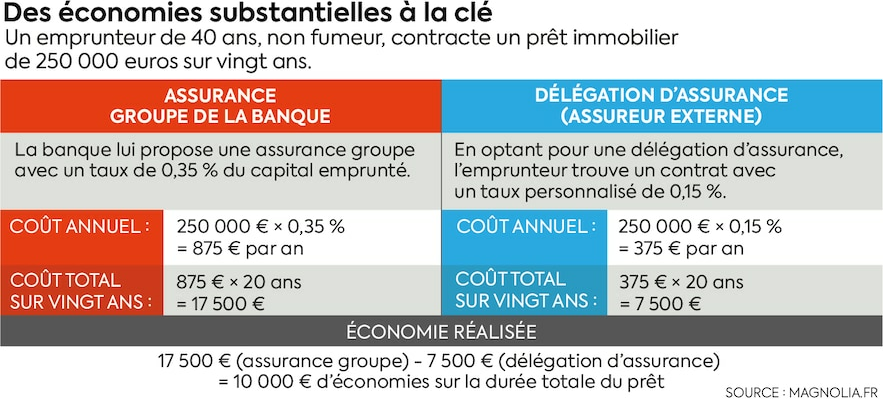

Nothing obliges the borrower to accept the insurance of the bank granting him the loan. It is possible to take out it with another company, at rates generally between 0.08% and 0.20% for borrowers under 45 years old. Brokers estimate the savings made by delegating insurance at an average of 15,000 euros. “The contracts offered by banks are more pooled, there is less of a difference in rates between profiles,” explains Maël Bernier, spokesperson for Meilleurtaux. Conversely, external contracts are much more individualized: “The price varies depending on age, state of health, profession…”, adds the expert. Hence the gaps between the two, particularly for younger buyers.

If the bank is reluctant, delay

The insurance broker Magnolia.fr calculates that a 32-year-old borrower, non-smoker, taking out a loan of 250,000 euros over 25 years can go from loan insurance at 0.36% in his bank to 0.11% with an external insurer. The monthly payment thus drops from 75 to 23 euros, a total saving of 15,650 euros over the total duration of the loan.

The banks obviously do not view the operation very favorably. “They put pressure on the client by implying that the loan may not be granted if they do not take out home insurance,” reports Delphine Bardou, deputy general manager of the broker Réassurement-moi. However, the borrower is often pressed for time and stressed by the numerous administrative constraints linked to their property purchase. “In this case, it is better to take out loan insurance from your bank so as not to make waves. There will always be time to change it later,” recalls Delphine Bardou.

Substantial savings at stake.

© / The Express

Equivalence in 11 out of 18 criteria

Since the Lemoine law of February 28, 2022, it is possible to cancel your borrower insurance at any time, in other words, from the day after your real estate purchase. “The sooner the better: the saving will be all the greater if the change of insurance is made quickly,” recommends Astrid Cousin, spokesperson for Magnolia.fr. But nothing prevents you from doing it later. In practice, you have to start by looking for a new contract. “The customer indicates on our site the bank that granted them the loan so that we can offer them contracts with at least equivalent guarantees, because otherwise, they have the right to refuse the change of insurer,” relates Astrid Cousin. Specifically, the new contract must be in accordance with at least 11 of the 18 guarantee criteria set by the Financial Sector Advisory Committee (CCSF).

Once the new contract has been taken out, the customer sends an insurance cancellation request to their bank, accompanied by the general conditions of the new contract and the membership certificate. The bank has ten days to respond. It may request additional information, accept or refuse if the guarantees are not equivalent. “We recommend choosing a date for the new contract to come into force one month after the termination request: this leaves a little margin in case the bank drags and we need to revive it,” specifies Astrid Cousin. Delays lengthen if the customer must carry out a medical examination based on their responses to the health questionnaire provided by the new insurer. Note that, since June 1, 2022, loans of less than 200,000 euros no longer require a medical questionnaire. Limited formalities for immediate gain.

.