Quite a symbol. At the beginning of September, the report on competitiveness drawn up by Mario Draghi – Giorgia Meloni’s predecessor as head of the Italian government – was made public. A few weeks later, Italy became the fourth largest exporter in the world, ahead of Japan, in the first six months of the year. Only China, the United States and Germany are now ahead of it. France continues to fall in the rankings and is in seventh place. Worse, it saw its trade deficit widen by 8.1 billion euros in the month of September alone, when its transalpine neighbor posted an insolent surplus of 2.5 billion euros. “There has been a certain continuity in the country’s desire to conquer this fourth place,” assures entrepreneur Edoardo Secchi, founding president of the Italy-France Club.

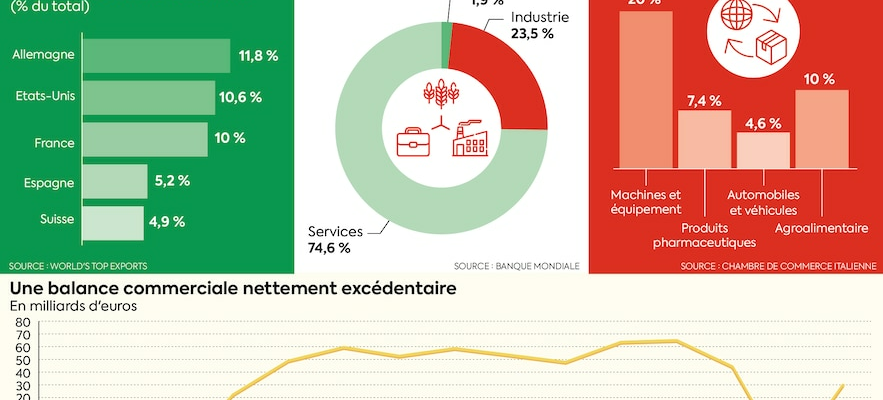

A small victory for the President of the Council of Ministers. On October 21, 2022, almost a month after her victory, she presented her first government. The first woman in history to head the Boot then renamed the Economic Development portfolio the Ministry of Enterprise and… “Made in Italy”. A bias that owes nothing to chance: the transalpine economy relies heavily on its exports due, in particular, to weak domestic demand. Exchanges intended primarily for Germany, the United States, as well as two neighbors, France and Switzerland.

A model in the shadow of Germany

The Italian model has long been underestimated, even unknown. Wrongly. “We have always had our eyes fixed on Germany, because it is the European leader in terms of size and density, even if its industry is suffering today,” confirms Olivier Lluansi, professor at Cnam and author of Reindustrialize. The challenge of a generation (The Deviations). However, Italy has arguments to put forward against the leading economy of the Old Continent. Its main strength? A hyperconnected industrial fabric made up of 99% small and medium-sized businesses. In 2022, it had nearly 366,000 industrial firms, compared to less than 210,000 in France, for an added value weight in GDP of 23.5%, according to the World Bank, compared to 16.8% in France.

These companies, most often family-owned, are grouped together in industrial districts. Agri-food, furniture, clothing, leather… There are more than 140, distributed mainly between the north and center of the country. “It is a unique phenomenon. They were formed spontaneously thanks to workers and employees who created new entities alongside those in which they worked. The SMEs and ETIs which are part of them are both competitors and allies “It’s a great force for exports,” underlines Fabrizio Maria Romano, president of the Institute for France-Italy Economic Relations. It sometimes happens that around thirty VSEs collaborate to respond to the request of a foreign client, only to then compete for another contract.

“They have the ability to adapt very quickly to change and are not afraid to recognize an error, even if it means reversing a bad decision,” says Antoine Mangogna, general manager of the Italian ETI SAATI, specialized in fabric manufacturing. techniques and chemicals. Based in Italy since 1988, this French leader never thought of returning to his country of origin. “Like me, many expatriates have caught the Italian virus,” he says. “There is not the same spirit, the same love of work as elsewhere.” For Fabrizio Maria Romano, “the Italian exporter is more flexible. Sometimes French companies tend to sell a product that has already been designed internally, rather than trying to build it with the customer.”

A state less strong than in France

However, district operation would be difficult to replicate in France. “We have long presented Italian clusters as a model, which are fantastic examples of cooperation between several SMEs, on very specific themes. But the absence of a similar culture of collaboration does not allow this pattern to emerge here” , believes Olivier Lluansi. Generally speaking, the Italian landscape is clearly different from ours. “This country has a lower level of political, economic and historical centralization than that of France. The regions still have a significant weight in the implementation of economic policy. This favors a more decentralized industrial structure,” notes Charles- Henri Colombier, director of the economic and outlook division at the Rexecode Institute.

The political situation today seems stable. This was not always the case… Since the financial crisis of 2008, eight governments have succeeded one another – and more than 70 since 1945. An inconsistency which has led companies to organize themselves. “Italy’s success is not due to the central State. It is explained firstly by the capacity of entrepreneurs present in each region to maintain professions which, for some, date back to the Middle Ages. It is due also to maintaining production on their territory rather than relocations”, explains Edoardo Secchi. “The administration is not capable of launching major projects and making rapid decisions. So, companies are coping,” says Denis Delespaul, president of the France-Italy Chamber of Commerce and Industry. The country was still able to recover from the sovereign debt crisis in the early 2010s. “We must put part of this recovery to the credit of the structural reforms taken at that time. It is sometimes painful, but it pays,” judges Olivier Redoulès, director of studies at Rexecode.

© / The Express

Recognized know-how

To expand abroad, SMEs and ETIs rely on recognized know-how, particularly in mechanical parts, but not only. Pharmaceuticals, automobiles and the food industry are particularly buoyant. Small structures benefit from the aura of large exporting companies like Barilla, Ferrero or EssilorLuxottica. “Italy is extremely well integrated into value chains as a supplier of intermediate products. Its role took on even more importance when there were supply problems, at the time of the Covid-19 pandemic,” notes Cristina Mitaritonna, economist at the Center for Prospective Studies and International Information.

It is not uncommon to come across an Italian machine in European factories… even in Germany, a pioneer of its kind. Above all, the Italian industry has been able to make a spectacular move upmarket in recent years. “The fruit of a real policy of improving product quality”, certifies Olivier Lluansi. Not to mention the promotional work led by the diaspora. “Italians who live abroad are little ambassadors. They manage to spread the interest in made in Italy and create a network,” illustrates Edoardo Secchi.

The enviable picture, however, presents some shadows. As the Italian population continues to age – more rapidly than in other European Union countries – generational transmission becomes a headache. Italy, like Germany, has seen energy costs skyrocket with the war in Ukraine. A drag on the competitiveness of its industry. Finally, by relying on this sector, the Italian economy is missing out on other promising segments. “Apart from manufacturing, there is a skills deficit. Very few people today are trained in the professions of the future such as those linked to artificial intelligence,” regrets Edoardo Secchi. A worrying deficiency, especially since this technology is spreading everywhere, including in industry.

.