150. This is at least the number of individual PERs currently marketed. You will find them wherever personal finances are discussed, with this same catchphrase: “Prepare for your retirement by lowering your taxes.” This slogan tells you about the packaging, common to all PERs. But it tells you nothing about the contents, which are very uneven from one envelope to another. So, which PERs should you subscribe to? Which ones to avoid? To answer these questions, some investigation is necessary. Here are the six key points to validate before subscribing.

1. Focus first on managing your money

Any investment, including PER, should be judged primarily by the financial solutions it integrates. What fuel for your savings? By law, any PER includes so-called “horizon” management, which will gradually secure the invested capital. The horizon in question is that of retirement (your expected retirement age), and no other. Don’t expect too much to recover your savings before this fateful date.

Who is in charge of this management? And with what supports (“units of account” in the jargon)? These are the other prerequisites to know, failing to obtain a history of past performances.

Also take an interest in securing capital. While some PERs desensitize capital year after year, by reducing the share allocated to risky investments, others only do it every three or five years.

Also ask yourself what the receptacle support is. The fund in euros guaranteed or a simple monetary fund, probably less efficient? In short, you must put this long-term management imposed by default in the PER into perspective, unless you expressly opt for free management of your savings. In this case, you manage your contract yourself, as you see fit.

© / THE EXPRESS

Before you get started, take a close look at the list of financial supports, knowing that many PERs are based on single-establishment management, generally a subsidiary of the group to which the distributor who sells it to you belongs.

Last option, management under mandate (also called piloted), sometimes entrusted to an external management company, which is gradually taking place in general public PERs. Here too, take stock of the content and past performance. Note that there are some PERs (Inter Invest, Yomoni) backed by a securities account instead of life insurance, allowing you to invest in broader financial universes. But these products are devoid of euro funds and benefits in the event of death.

Another category of PER, called in points, is offered (at Garance, Medicis, Monceau, Préfon) with the advantage of simplicity, since we accumulate points which have a guaranteed value in euros. They have the disadvantage of making you dependent on the insurer’s management.

2. Make an accurate statement of costs

Having a quality financial offer is a prerequisite, but also know what its cost is. Suffice it to say: the PER is an expensive investment to pay for. All costs are listed in the contractual notice and on the distributor’s website. These counts are enough to make you dizzy…

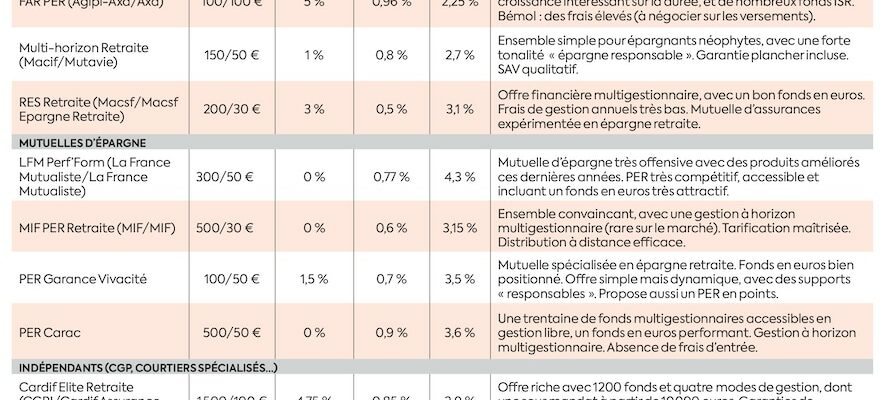

Which ones to target first? Those taken annually from your capital. On average, a PER displays 0.90% management fees per year, a threshold often exceeded if you opt for management under mandate (+ 0.25 to 0.50%) or if you have subscribed to pension options. Conversely, some players demonstrate moderation: it is possible to find contracts costing only 0.50% or 0.60% per year. Do not neglect this drain, which, repeated every year, will weigh heavily on the growth of your savings.

More visible are the fees on payments, which range from 0 to 5% (legal maximum) depending on the PER, with an average rate of 3%. Translation: you pay 100 euros, only 97 are invested, the rest is lost while your savings have not yet earned a cent. Please note: these fees are negotiable.

Please note, many other charges punctuate a PER, most of which are invoiced following an act of management (for example arbitration) or the use of an option (managed management, additional death guarantees, etc.). In the end, the bill can be heavy, hence the importance of doing your accounts before subscribing.

3. Check the services offered

There is one last useful criterion for sorting the offer: after-sales service. What is it about? Mainly IT tools made available to you to manage your PER. Example: will you be able to carry out a management act on your PER directly online? If yes, within what time frame will it be executed? What information will be communicated to you in your customer area? And at what rate will they be updated?

If you invest in free management, it is important that you can count on reliable decision-making tools to sort funds or check their performance. On these points, the ergonomics of spaces vary greatly from one establishment to another. Note that some of them also offer their clients retirement advice services, which can be a plus.

4. Beware of unnecessary arguments

For the rest, beware of biased analyzes from your financial advisor, however competent he may be, since he will promote the products on his shelf. Some thus oversell the multiple exit methods of their retirement product, with sophisticated life annuity options. Unless you are very close to the fateful date and convinced of the interest of the annuity (which the French shun), it is of no interest to you. Instead, take a look at the capital outflow of the product, the flexibility being unequal from one PER to another. Some allow you to withdraw your capital freely, while others limit the possibilities.

In terms of superfluities, the inclusion of insurance is also in full swing in PERs. The standard floor death guarantee, which ensures that the beneficiary(ies) will receive at least the capital you have invested (net of fees) in the event of death, is useful, particularly when the savings are invested offensively because the insurer will then transmit all the premiums paid, even if the contract is in a loss of value. On the other hand, PERs are increasingly accepting pension options of all kinds, priced at high prices (for example, 0.15% additional costs to double the capital in the event of accidental death), with amounts capped and numerous exclusions (age, risky sports, etc.). They should be avoided.

Finally, the strength of the insurer is not a determining factor, even if the big companies will tell you the opposite. The supervisory authorities are reassuring on this point – the market is healthy – and no one has a crystal ball to know what it will be like in thirty years.

5. Focus on performance… wherever possible

The judge of an investment is its financial performance net of fees. Five years after the launch of the PER, it is clear that the communication of financial institutions on this point is… minimalist. In their defense, horizon management, widely promoted in general public PERs, makes the information indigestible as the investment layers are numerous, differing according to age and the profile chosen. For example, in the Crédit Mutuel PER, you have 30 solutions depending on the time separating you from retirement, which, combined with the three existing risk profiles, results in… 90 performances for the same year.

Comparing data between insurers then becomes a headache, especially as the profiles vary in content regarding the risk taken. Only the guaranteed euro fund is a tangible benchmark, each insurer displaying a single rate (possibly enhanced under conditions). In 2023, the average yield was close to 2.80% net. This figure, however, masks significant differences in the market, with banks and savings mutuals having generally taken the lead in this area.

6. Knock on the right door

With this background, you will gain autonomy. All that remains is to approach the market with lucidity. Everyone is in fact often captive to their usual distributor, including for an investment intended to be kept for many years. Unsurprisingly, the banks are at the forefront, all deploying a general public PER without much fanfare, but also more sophisticated solutions for their wealthiest customers. Behind, traditional insurers, which you use to cover your car or your home, are there, but with fairly expensive products.

Above all, do not hesitate to open other doors, such as that of mutual savings companies, whose PERs combine simplicity and efficiency. For more financial solutions, however, the route of independent wealth advisors and online brokers is essential. In addition to the content of the product, it is also your saver profile that will guide you in this crowded market.

Moral of the story: savers have every interest in “buying” their PER rather than subscribing to the one that is “sold” to them.

.