The retirement savings plan (PER) is celebrating its fifth anniversary. Certainly, from the top of its 108.8 billion euros in assets, it is far from overshadowing the nearly 2,000 billion placed by savers on life insurance. But it has gradually established itself in the investment landscape by replacing all existing systems dedicated to retirement such as the Perp (popular retirement savings plan), the Madelin, the Perco (collective retirement savings plan ) or the old “article 83” contracts.

This envelope is offered in its collective version by companies to their employees, and in its individual version – open to all – by banks, insurance companies, mutual societies and provident institutes. The latter has three compartments: one to collect voluntary payments from the saver, the other for transfers from employee savings and the last for transfers from a compulsory company PER. “These different pockets each have their own mode of operation with specific taxation, or even exit conditions,” recalls Gilles Belloir, the general director of Placement-direct.fr.

Common to all plans: it is a “tunnel” product, from which it is not possible to exit before retirement, except in exceptional cases. “This is a virtuous constraint: blocking funds protects the saver against the temptation to recover their capital prematurely,” believes Guillaume Eyssette, founder of the independent asset management firm Gefinéo. Buying a new car, renovation work, children’s studies: there is no shortage of opportunities to spend the few tens of thousands of euros set aside. This is simply not possible when the money is deposited in a PER, with a few exceptions. The regulations provide for some exit options in the event of the purchase of the main residence or a life accident. In particular, it is possible to unlock your savings free of charge and without tax in the event of disability, death of a spouse, expiration of unemployment rights, over-indebtedness or cessation of activity following a court judgment. judicial liquidation. These cases being exceptional and unpredictable, you should therefore only pay into a PER sums which you are certain you will not need before retirement.

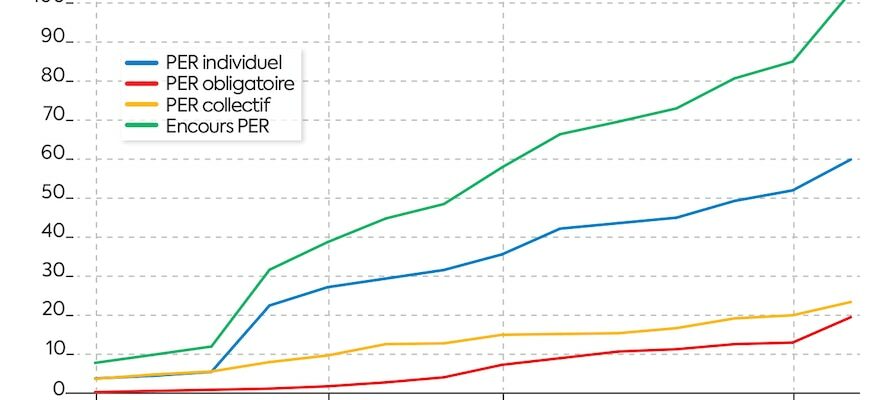

The evolution of the outstanding amount since its creation.

© / THE EXPRESS

Despite the constraint of blocking funds, the success of the PER is largely explained by its tax advantage on entry. Voluntary payments are deductible from taxable income within the limits of certain ceilings, which depend on the professional status of the holder. Employees deduct payments from their income up to the highest amount between 10% of their professional income, within the limit of 35,194 euros for payments made in 2024, and 10% of the annual Social Security ceiling, i.e. 4 399 euros in 2024. For self-employed workers, the ceiling is higher and arises from taxable profits. It can go up to 85,780 euros. “The higher the taxpayer’s marginal tax bracket, the greater the tax advantage,” summarizes Alexandre Boutin, director of heritage engineering at Primonial. An employee in the 30% bracket placing 10,000 euros on a PER realizes a tax saving of 3,000 euros, so their real savings effort is limited to 7,000 euros. For a taxpayer in the 41% bracket, the tax saving even reaches 4,100 euros. “The PER is aimed at the most heavily taxed savers: the tax advantage is too limited for households in the 11% bracket, given the constraint of blocking funds,” estimates Gilles Belloir.

The PER is accessible at any age (you simply have to be an adult, the envelope no longer being accessible to minors since January 1, 2024). But the longer the investment horizon, the more time the accumulated capital will have to grow. In their thirties, young professionals often have priorities other than preparing for retirement, such as purchasing their main residence, but nothing prevents them from starting with small amounts. “Funding your PER with scheduled monthly payments is a good idea. Once the system is set up, you no longer need to think about it and it is still possible to interrupt or adjust the amount if necessary,” adds Guillaume Eyssette.

As with life insurance, the supports offered are extremely varied: they range from funds in euros with guaranteed capital to the most varied units of account (real estate, shares, bonds, etc.). The saver has the choice between free management, in which he keeps control over his investment choices within the PER, and managed management, thanks to which he delegates arbitration decisions to a professional. “The saver determines his risk profile (“prudent”, “balanced”, “dynamic”, “offensive”), then his asset allocation is gradually secured as the retirement date approaches”, explains Martin Alix, director of product development at Primonial. In other words, for a “prudent” profile, the share of risky assets can reach 70% if the saver retires in more than ten years; 20% if it is between two and five years and 10% maximum when the horizon is less than two years. The objective? Avoid a bad schedule which would force the holder to recover their savings while the financial markets are at their lowest.

The tax advantage on entry alone is enough to decide many savers to fund their PER. But the device has another advantage. “The big new thing is the capital outflow, which was almost impossible with the old retirement savings systems,” emphasizes Alexandre Boutin. However, annuity withdrawal remains authorized. In this case, and if the saver benefited from the tax advantage upon entry, the annuity is subject to income tax in the category of pensions and annuities after a 10% reduction and subject to social security contributions. after a reduction whose amount depends on the age at the time of liquidation of the plan. In the absence of an advantage upon entry, the annuity is subject to income tax and social security contributions, the two levies this time being calculated after a reduction depending on age.

In the event of a capital outflow, when the saver has benefited from the tax advantage upon entry, the sum corresponding to the payments is taxable at the income tax scale, while capital gains are subject to withholding tax. single flat rate of 30%. In practice, it is advisable to carry out progressive partial redemptions, depending on your needs, to limit the tax impact. Indeed, a massive one-time redemption could in certain cases push the taxpayer into the upper marginal income tax bracket. If the payments have not been subject to a deduction upon entry, then only the winnings are taxed, at 30%.

Profiled management opens up to the unlisted

The “Green Industry” law requires the inclusion of a minimum portion of unlisted assets (investment capital, private debt, etc.) in life insurance retirement savings plans since October 24. The objective? Direct part of the French nest egg towards the real economy. This portion varies in the PERs depending on the subscriber’s risk profile (“prudent”, “balanced”, “dynamic”, and now “offensive”, the latter profile being introduced by this same law) and the time remaining before departure retired. For example, it will be at least between 3% and 8% depending on the investment horizon for a “balanced” profile.

This measure is not unanimously accepted for life insurance because it poses in particular the problem of the liquidity of this type of asset. However, the PER – which is blocked until retirement – lends itself rather well to this type of investment. “Savers who already have a long-term management plan will gradually have access to new allocation grids including the unlisted,” explains Gilles Belloir, the general manager of Placement-direct.fr. However, they will be able to remain on their old allowance, including for their new payments.”

.