Again. European companies focused on exporting to the United States or established across the Atlantic will once again have to deal with the “Trump factor”. The discussions around customs barriers in recent months have revived a still sensitive wound for Europe, which has not forgotten the protectionist measures taken during its first mandate, such as taxes on steel and aluminum, or even on wine. However, this time the shocks could gain in intensity: companies find themselves facing a “Trump squared”, who assumes a potentially more radical policy, analyzes François Rimeu, strategist for Française AM (Crédit Mutuel).

Tariffs on imports constitute the main ingredient of its trade policy. They would amount to 60% for Chinese products and at least 10% for the rest of the world. And their implementation could be relatively rapid, since certain legislative provisions allow it to do without prior validation by Congress.

Exporters put to the test

The president-elect does not like trade imbalances, especially if they are to his disadvantage. Bad luck, the European Union exports far more goods to the United States than it imports. In 2023, the country accounted for 20% of non-European exports, underlines Pierre Bossuet, economist on the trading floor of Crédit Mutuel Arkéa. In recent months, Donald Trump has increased his invectives against the Old Continent, which he has not hesitated to describe as “mini-China”.

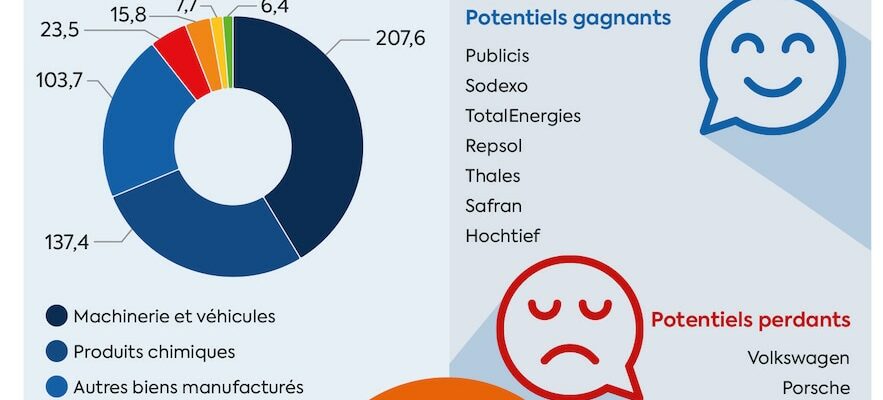

However, customs duties may not affect all imports at once. “Initially, it is more likely that Trump will target certain sectors in particular,” envisages Ruben Nizard, head of socio-political risk analysis at Coface. Aeronautics, for example, had been a favored target during the previous mandate, when Trump attacked Airbus, recalls the economist. But it is far from being his only option: “Trump can choose to impose tariffs on what contributes to the trade deficit – for example automobiles, chemicals or machinery. But he can also target symbolic sectors , such as luxury or specialty products,” explains Ruben Nizard.

The automotive sector could therefore find itself in the eye of the storm. German manufacturers would be particularly affected, notably brands like Porsche, for which the United States is a key market, notes asset manager Oddo BHF in a report. “When he talks about the trade imbalance with Europe, Trump is actually addressing Germany. But in turn France will also be affected, even though its economy is less exposed to exports to the United States. This requires us to coordinate a common commercial policy,” warns Stéphanie Villers, economic advisor at PwC France and Maghreb.

Luxury also finds itself in uncertainty. Today dependent on the American market, it represents a real negotiating lever for Donald Trump, estimates Christopher Dembik, investment strategy advisor at Pictet AM. The sector could even experience a double sanction: in addition to the customs duties imposed on Europe, “customs tariffs against China would lead to an economic slowdown which could reduce Chinese demand for European luxury products. Groups like LVMH or Hermès are very sensitive to the situation in China,” explains Andrea Tueni, head of market activities at Saxo Banque.

Will these customs barriers be sustainable? Nothing is certain. “In his transactional approach, it is likely that Trump will brandish symbolic and targeted customs tariffs state by state to obtain trade concessions. For France, it would not be aberrant for him to put in place restrictions on cognac,” imagines Christopher Dembik. The spirits sector could therefore also be a prime target, which would undermine companies like Rémy Cointreau and Pernod Ricard, explains Andrea Tueni.

Finally, the geopolitical uncertainty emerging from the new president’s program could serve the interests of the defense giants, points out Andrea Tueni. “While Trump mentioned the possibility of leaving NATO, European countries could consider rearming themselves to ensure their own defense, without relying on the United States. This would benefit groups like Thales or Safran,” indicates -he.

© / The Express

Deregulation and tax cuts

For European companies established in the United States, the outlook appears less gloomy. The key point of Donald Trump’s domestic economic program, consistent with his previous mandate, is a reduction in corporate tax from 21% to 15% for players producing on American soil. Good news for local businesses, since his Democratic rival, on the contrary, promised an increase in taxation. “European companies already present on site, such as the French group Publicis which generates 62% of its sales in the United States, would benefit from this measure,” specifies Thomas Zlowodzki, head of equity strategy at Oddo BHF.

Second factor of rejoicing for locally established companies: regulatory relaxation. During his previous term, Donald Trump stated a golden rule: one regulation put in place cancels two others. An opportunity to be seized for the mining exploration sector and for fossil fuel players. In line with its slogan Drill baby, drill!, the Republican president could grant more drilling permits for shale oil and gas. “We can imagine a resumption of drilling in Alaska, for example. This policy would benefit players like the Spanish oil giant Repsol, which provides a third of its production in North America,” estimates Andrea Tueni. However, this deregulation does not necessarily mean new projects immediately. “The decision to invest or not is not simply made over a four-year presidential cycle. Companies in the sector will obviously think about 2028,” says Ruben Nizard, at Coface.

Donald Trump also plans to reverse the moratorium on new American liquefied natural gas (LNG) export terminals put in place by Joe Biden. A measure which would notably benefit TotalEnergies, the leading exporter of American LNG, explains Andrea Tueni. Indirectly, a revival of gas exports could also be favorable to other European companies: “Larger exports of LNG would contribute to lower energy prices in Europe and would favor the activities of certain European industries that consume a lot of gas. energy, like chemistry”, explains Thomas Zlowodzki. On the other hand, European electricity producers would suffer from lower gas prices.

On the energy transition aspect, the new president plans a 180-degree turn compared to his predecessor. During his campaign, Donald Trump multiplied the evidence of his hostility towards wind energy, which he described, among other things, as “horrible”. European renewable energy developers are keeping a watchful eye on the situation: France’s Engie and Spain’s Iberdrola, for example, are engaged in several offshore wind projects off the American coast.

The electric vehicle sector is also on the front line. Donald Trump raised the possibility of ending purchasing aid at the federal level, which currently amounts to $7,500 for a new vehicle. Enough to slow down demand for a sector which is already going through a period of turbulence. Players like Volkswagen, which produces on American territory, could suffer the impact of this measure, indicates Oddo BHF, specifying that producers of combustion vehicles would be favored. On the other hand, Stellantis and BMW have more flexible production chains and could quickly switch to the production of more thermal vehicles, nuance the asset manager. However, the Tesla boss’ support for Trump’s campaign casts doubt on the future of electric car manufacturers. “It would be surprising to see Elon Musk suffer from Trump’s policies,” concedes François Rimeu. “Either they will find a trick to get Tesla out of it, or Trump will not touch the subsidies.”

.