A hostile land filled with enemies and traps. This is what the “next world” looks like for video game leader Ubisoft. Since the Covid parenthesis, the group, whose unions are calling for a three-day strike from Tuesday October 15, has seen its share price collapse: a fall of -84% since February 2021. The situation is such that the rumors are now buzzing around a possible takeover by the Chinese Tencent of this Frenchman who has become a big name in video games. According to Bloombergdiscussions are underway. And Ubisoft was careful not to firmly deny the information, contenting itself with evasively indicating that it was studying “all its options”.

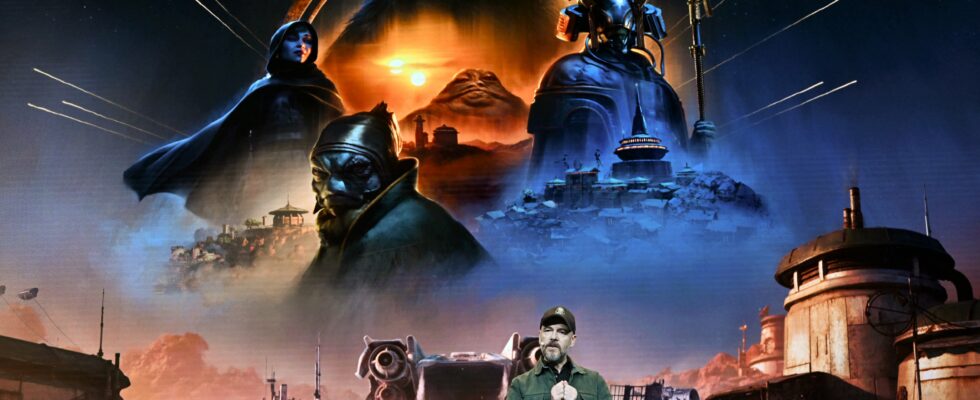

What future is emerging for the Guillemot brothers’ company? To get an idea of it, you have to understand the reasons for its setbacks. “First and foremost, the accumulation of games has not met with the expected success,” points out Charles-Louis Planade, director of international operations at the investment bank TP ICAP Midcap. Star Wars Outlawson which Ubisoft was betting big, did not achieve its sales objectives. A real disappointment given the fame of the franchise, its fun potential (worlds, bestiary, etc.) without forgetting… the price of Disney licenses.

The pirates of Skull and Bones (2024) didn’t fill Ubisoft’s coffers with gold coins either. And over the course of the decade, the group has never succeeded in imposing its license Watch Dogs released in 2014. “Ubisoft raised far too many expectations around this game, making it seem like a revolution. In fact, it was just a very good game,” points out Julien Pillot, digital economist and teacher-researcher. at Inseec Business School.

The problem is that Ubisoft operates in the world of so-called “Triple A” games, namely the most sophisticated and expensive. “Failure is not forgiving in this world,” confides Adrien Brasey, analyst who monitors the group’s performance for the independent research firm AlphaValue. Ubisoft has widely recognized expertise in creating “open world” games. The most complex to build, because here the player is not forced to follow a predefined path, he can explore, as he wishes, an immense playing field (a city, a planet, etc.). But it did not escape investors that other types of games now presented strong growth potential.

“The trend is to sell video games no longer as products, but as services. Which requires a life after purchase. For example, by selling game extensions, additional missions. Allowing microtransactions in the game to buy equipment or outfits is also on the rise”, underlines Julien Pillot. Ubisoft has managed to transform Rainbow Six Siege like a real cash cow, enriching it a posteriori.

Ubisoft faces tough competition

The group, however, is struggling to transform the test into “free-to-play”, these free games where the publisher draws its income from the sale of optional objects (weapons, outfits, etc.). HyperscapeTHE battle royale launched by Ubisoft to compete with Fortnite and PUBG, did not appeal to the public. The recent tactical shooter XDefiant neither. “The market has the feeling that Ubisoft is having difficulty exiting its historical specialty segments and this is disappointing,” observes Charles-Louis Planade. Especially since on the other hand, the competitive landscape has been redrawn.

A wave of massive mergers and acquisitions has swept through video games. Sony paid $3.6 billion to acquire Bungie. EA, 2.1 billion for Glu Mobile. And Take-Two broke the bank to take out the $12.7 billion that allowed it to get its hands on Zynga. The most memorable takeover being that of Activision Blizzard by Microsoft, in 2023 for $75 billion, a few years after that of Zenimax (2021) and Mojang (2014).

“This wave of mergers and acquisitions has slowed down,” explains the director of international operations at the investment bank Midcap. But the Guillemot brothers’ company today finds itself faced with real colossi who have operated all possible synergies and have shed their duplicates. “Ubisoft has too many studios and too many employees,” believes Juraj Krupa, founder and CEO of AJ Investments, a Slovak activist fund which holds less than 1% of Ubisoft’s capital.

Competition, however, is not the only factor that has weakened Ubisoft. In 2020, Release And Numerama reveal in careful investigations the sexual and moral harassment suffered by numerous employees. Several heads jump. In particular that of the vice-president of the editorial department Thomas François. Ubisoft number two Serge Hascoët will resign shortly after.

Internal teams also have to deal with sometimes acerbic Internet users. “All publishers must face the more or less good reactions of players depending on the quality of their title, that’s the game. But Ubisoft seems to be targeted more than rightly. Its monetization strategies are, for example, very criticized while the competition does much the same,” says a sector expert astonished. And people, like Elon Musk, like to stir up controversies around certain choices of the group, such as that of creating a black samurai character in the next Assassin’s Creed.

All of this creates a difficult climate for Ubisoft employees. Especially since salary increases have become rarer over the past two years, several of them confide to L’Express. “It was to push people out the door,” said Alice*, a Ubisoft employee. “But it was the worst thing to do, because those who leave are generally the brightest and most motivated who manage to find elsewhere.”

The return to the office makes you cringe

In an email sent on September 17, 2024 to all Ubisoft teams, which L’Express was able to consult, management also announced changing its teleworking policy, and adding one day of mandatory face-to-face attendance to the two required until then. An announcement taken without consulting the teams, who experience it as “a direct attack against them”, explains a representative of the CGT, wishing to remain anonymous. The arguments put forward by management to justify this choice – more efficient work and greater creativity thanks to informal conversations – are difficult to convince. “In my team, we work in four different countries, so we have never crossed paths,” points out Alice. There are many in his case: the majority of the group’s forty studios are abroad, and productions regularly take place on several continents at the same time.

Despite the headwinds that Ubisoft faces, the group retains solid assets. The much awaited Assassin’s Creed Outlaw which will be released next February should bring in big profits. Far Cry, Tom Clancy’s, Rayman… The Frenchman has many other renowned franchises. A rich catalog base which allows it to generate income, even when its launches flop. “Ubisoft is in a segment where the barriers to entry are immense. No new direct competitor has really emerged,” argues Charles-Louis Planade.

Certainly, Ubisoft thought a little big, especially in its workforce. While in 2022, an EA identified 13,000 employees for 6.9 billion dollars in turnover, Take-Two, 8,000 for 3.5 billion and Activision 13,000 for 7.5 billion, Ubisoft identified 20,000 employees for 1.8 billion turnover. But the studio went on a diet and planned a cost reduction of 200 million euros over two years. It has already reduced its workforce by around 2,000 positions.

“If Ubisoft’s competitors have a more flattering ratio of payroll to turnover, it is in reality because they outsource their production much more, denounces economist Julien Pillot. This strategy pleases financiers, but it will serve these publishers in the long term.” The control that Ubisoft has over all the links in its creative chain is indeed precious. “And with another 850 million euros of liquidity declared at the end of September, Ubisoft still has a very solid financial structure,” specifies Charles-Louis Planade of Midcap bank.

The video game market still offers juicy opportunities. This may come as a surprise, given the massive layoffs that the sector has recorded this year (11,000 worldwide since January). But these carts are above all the consequence of poor management of many studios and a runaway during the covid period. During the confinements, video game sales increased, which encouraged publishers to increase the number of projects. The launches of certain major productions having been postponed at the same time, the releases collided.

“If the Guillemots were only concerned with selling the group…”

“This traffic jam is being resolved. There will be fewer launches in the years to come, and new games will therefore have a better chance of succeeding. The takeover of Keywords studios by the EQT fund shows that venture capitalists have a lot of faith to a rebound in the sector”, confides Charles-Louis Planade. Video games are, let’s not forget, the best-selling cultural good in the world now. “And this will still be the case in twenty years,” assures Julien Pillot.

So what does the future of Ubisoft look like in the medium term? Contacted by L’Express, the group has not yet made any comment. But there is little doubt about the Guillemot family’s attachment to the future of the company. “Vivendi, EA… Several companies wanted to buy Ubisoft in the past. If the Guillemot family was only concerned with selling the group, they could have done so much earlier at a better price,” points out analyst Adrien Brasey of the firm AlphaValue.

The question of succession arises, however, because the Guillemot brothers have not designated one for Ubisoft. The idea of a buyout of the company in the more or less long term is therefore very plausible. Venture capital funds or large tech companies would have good reasons to be interested in Ubisoft, especially once it has ironed out its management. “But the agreement between Tencent and Ubisoft in 2022 is designed so that the Guillemot brothers maintain control of the company and in order to prevent an outside company from being able to make a hostile takeover bid. This means that the market reacted very negatively to this agreement”, analyzes Adrien Brasey.

In the eyes of most of the experts interviewed by L’Express, the most logical scenario is that the Guillemot family and Tencent organize a delisting in tandem in order to calmly restructure the group. “And that they are planning in the longer term a peaceful takeover of Ubisoft by Tencent,” specifies Julien Pillot. Contacted, Bercy did not wish to comment on this possibility, but the risk that the French authorities would block such a file seems moderate. Ubisoft is a great French success but the group does not operate in a sensitive sphere.

For the Chinese giant, this would be a great catch. Certainly, Tencent already has a video game empire, which it has intelligently strengthened through targeted acquisitions, particularly on the Old Continent. Thus, the Finnish Supercell, the British Sumo, the Polish Techland and the Swedish SharkMob fell into his hands. But the French Ubisoft would allow it to strengthen itself in open world games. At a time when the United States is closing an iron curtain on China, this would be a breath of fresh air.

.