“The electric car market in Europe is on a downward trajectory and continues.” In a press release published on September 19, the European Automobile Manufacturers’ Association (ACEA), which brings together the 15 largest of them, with the notable exception of Stellantis, sounded the warnings. This lobby is urgently calling on European institutions for support measures before the tightening, on January 1, 2025, of the rules to which manufacturers are subject on the CO2 emissions of their fleets.

Renault boss and ACEA president Luca de Meo is worried about this.. Criticizing the heavy fines that are looming over manufacturers in Europe, at a time when competition is raging with Tesla and Chinese brands, he pleads for more “flexibility” in the application of this timetable.

An “absurd” request, retorts the NGO Transport & Environment, which believes that “it is these standards that are driving investments today and giving visibility to economic players”. Dialogue of the deaf? Mandated by the European Commission to reflect on the future of competitiveness in Europe, Mario Draghi has invited himself to the debate. At the heart of a voluminous report unveiled on September 9, the former head of the European Central Bank underlines that the automobile sector “is the perfect example of the lack of planning of the European Union, by implementing a climate policy without an industrial policy”. And to recall that “the Commission only launched the European Battery Alliance, in order to build a battery value chain in Europe, in 2017, while Europe as a whole is very behind in the installation of charging infrastructure. China, on the other hand, has been interested in the entire value chain since 2012 and, consequently, it has moved faster, on a larger scale.”

Europe’s late awakening

Chinese manufacturers are expected to export almost 6 million electric vehicles to more than a hundred countries this year. Unprecedented. Brands that are virtually unknown to the general public – BYD, Geely, SAIC, etc. – with unbeatable prices: $19,000 on average, half the price of a car of the same range from a European manufacturer. However, the closure of the American market, caused by the introduction of prohibitive customs duties on Chinese cars by the Biden administration, has made the EU a prime target. Especially since the Chinese domestic market is marking time.

To counter this wave, Europe has finally woken up and also brought out its tax weapon. At the end of an investigation that lasted months, the Brussels Commission proposed on July 4 to increase import taxes on Chinese manufacturers, to 17.4% for BYD and up to 37.6% for SAIC. A notable step forward for an institution that has always been reluctant to show its muscles, fearing the consequences of a trade war with Beijing. But an insufficient gesture to truly protect European manufacturers. First, because the margins of Chinese groups are so comfortable that they can easily absorb these customs tariffs. Second, because this decision was only taken for four months. Everything still remains to be done. On September 30, the 27 Member States will have to vote again on whether or not to perpetuate this tariff response for the next five years.

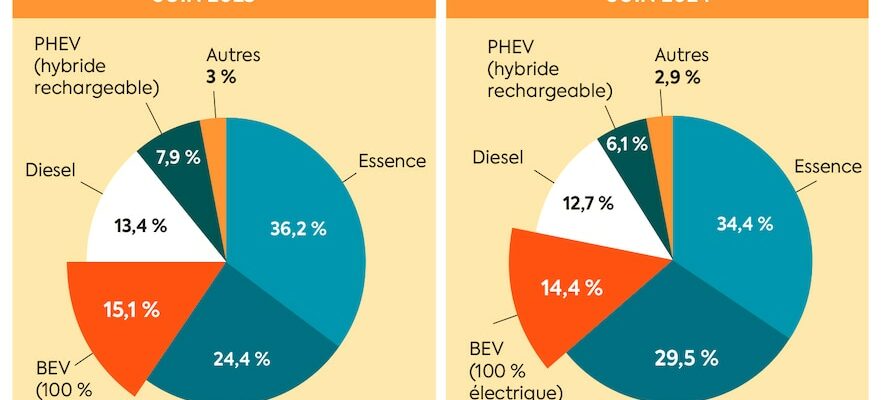

The appeal of 100% electric is eroding.

© / THE EXPRESS

Cognac in the crosshairs

Recently, some Chinese manufacturers have tried to do good measure by proposing to limit their sales, via import quotas. “Unacceptable offers”, whispers a senior official close to Valdis Dombrovskis, the European Commissioner responsible for the subject. So, Beijing has shifted into high gear. “And as usual, the Chinese government is trying to play the card of division between Europeans”, observes Elvire Fabry, researcher at the Jacques-Delors Institute. It must be said that in July, the stick of customs duties did not meet with unanimous approval among the Twenty-Seven. According to our information, four countries opposed it during a consultative vote: Hungary – China’s bridgehead in Europe -, Malta, Cyprus and Slovakia; 11 abstained, including Germany, Austria, Finland and Sweden. And 12, including France, Spain and Italy, voted in favour. Some defections in the protectionist camp, and the European response could go pschitt.

To bring some “rebels” into line, China has also launched its own anti-dumping investigations, threatening very sensitive sectors, such as the dairy industry. In France, cognac is in the crosshairs, with customs surcharges that could reach between 35 and 38% depending on the house. In Spain, it is ham that is in the hot seat, while the country is seen as the leading European exporter of pork to China. Blackmail that pays off. On an official visit to Beijing, Pedro Sanchez, the Spanish Prime Minister, recently changed his tune. “We must all reconsider our position. Not only the Member States, but also the Commission,” he declared at the end of this four-day trip during which the Chinese government confirmed an investment of one billion euros in an electrolyser plant in Spain…

Across the Rhine, car manufacturers, which had invested massively in China in recent years, find themselves trapped and are putting pressure on Chancellor Olaf Scholz to find an alternative. “My position is clear: we need a political solution,” declared Robert Habeck, the German Minister of Economy, last week. “The vote of the member states is crucial because it is the expression of the new commercial strategy of the European Union that will be played out,” concludes Elvire Fabry.

Copper-hungry batteries

Beyond these commercial and geopolitical considerations, the electrification of vehicles could also face an unforeseen obstacle: the lack of copper. A battery-powered model requires three to five times more copper than a combustion engine vehicle. And greening the electricity grid also consumes considerable quantities. In a recent study, two researchers from the University of Michigan warn that between 2018 and 2050, the world will need to find 115% more copper than has been mined since the beginning of humanity. To meet the needs of electrifying the global vehicle fleet alone, no fewer than six new large copper mines will need to be commissioned each year over the next few decades.

“I am a strong supporter of the IRA, the Inflation Reduction Act [NDLR : un texte qui subventionne les technologies vertes sur le sol américain]. I have solar panels, batteries and an electric vehicle. However, the energy transition must be carried out at a realistic pace,” confides Adam Simon, one of the authors. Instead of completely electrifying the American automobile market, the specialist, who assures that he has no conflict of interest with the automobile industry, suggests to take it easy on electric vehicles and to concentrate on hybrid models.

In a report released last March, the European Commission nevertheless castigates the latter. Their average CO2 emissions in real-world conditions are only 23% lower than those of conventional cars. Worse: these same emissions are 3.5 times higher than what is indicated by the standardized tests used for their approval. Because these vehicles are “much less recharged and driven in electric mode than expected”. Proof that there is a world of difference between the standard and “real” life.

.