A moment of grace in the history of the Internet. On November 13, 2014, for two hours, many Internet users were able to browse the web without advertising. DoubleClick was “down”, as tech professionals say. Out of service, in short. The anecdote highlights the importance of this service that the general public was discovering at the time, without knowing that it had been owned by Google since March 2008. The company, already very powerful in the searchacquired it for $3.1 billion, in the face of fierce competition from Microsoft and Yahoo!.

Merged into a new entity, Google Marketing Platform, DoubleClick is now back in the spotlight via the trial brought by the US Department of Justice (DoJ), which began on Monday, September 9. The trial aims to determine whether Google abused its dominant position to control the huge online advertising market, which peaks at $630 billion. Its complaint, first made public in January 2023, describes DoubleClick as “a first step in Google’s march towards monopoly.”

The role of this company allows us to better understand how the Mountain View, California, firm got its hands on the biggest piece of the pie – more than 220 billion in turnover each year. Forming the basis of its empire, which is now also available in artificial intelligence, cybersecurity and home automation, in a larger group called Alphabet.

Valuable ad server

DoubleClick is not Google’s very first brick in advertising. In 2000, the company successfully launched AdWords (since renamed Google Ads), allowing the display of small advertisements for each search by a user on Google, suggested according to the keywords used. The acquisition of the YouTube video service in 2006 also helped make Google a key player in the sector. Especially in terms of purchasing advertising space and technical intermediation. The Analytics tool, created in the mid-2000s, allows the study of the impact of advertisers’ advertising campaigns on its own sites, and beyond.

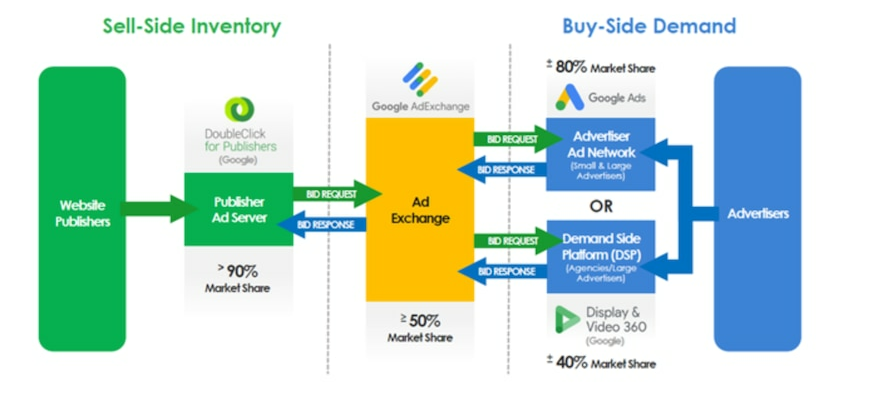

The online advertising market, which Google dominates in every sector.

© / US Department of Justice

But so-called programmatic advertising, omnipresent on the web, is comparable to high-frequency trading. No fewer than 150,000 advertisements are sold every second. The great complexity of the system therefore comes from the (extremely) rapid connection between sites, content publishers – the sellers – and advertisers – the buyers, therefore. This is where Google kills two birds with one stone. At the time, DoubleClick had just launched an advertising exchange. An “essential and costly” pipeline, comments Alban Peltier, head of the advertising start-up AntVoice. Where auctions are concluded automatically. Which now gives it a central role. And DoubleClick also has an advertising server. A valuable “inventory management software that keeps track of the number of advertising spaces a publisher has to sell”, describes American researcher Dina Srinivasan in his article titled “Why Google Dominates the Advertising Market,” published in 2019. Best in class. “Founded in 1996, listed on the Nasdaq – it was the world’s largest ad server and held about 57% of the market in the United States. A long list of news publishers, including Sports IllustratedAOL Online and the Wall Street Journalused DoubleClick to migrate their businesses from print to digital and to automate the process of targeting and selling ads,” continues Dina Srinivasan.

DoubleClick inevitable

This crucial information about the audience present on the sites most visited by Internet users, coupled with that which Google was already collecting via its own search engine and its various services, quickly made DoubleClick inevitable. Its new owner quickly understood this.

“In 2009, Google began restricting the ability of publishers and advertisers to access their DoubleClick data and reserving a key information advantage for its own business units,” says Dina Srinivasan. Enough to increase its profits tenfold. But also enough to get it into some trouble today. In the ad server business alone, DoubleClick has a 90% market share. And about 50% on the auction site. Too much, in the eyes of the American justice system. “Google operates simultaneously as a seller and a buyer, and runs an auction platform,” she denounces. “In court, we will show that buyers and sellers of ads have many options, and when they choose Google, they do so because our advertising technology is simple, affordable and effective. In short, it works,” she says. the company answers. Problem, one of its employees himself admitted, in an email extracted by the prosecution, the extreme domination of Google in advertising: “The analogy would be that Goldman Sachs or Citibank owned the NYSE [NDLR : la Bourse de New York]”. A comparison loaded with meaning that the DoJ intends to turn against the firm.

.