(Finance) – Italian Wine Brands has made it known that it is completed the buy-back program launched on December 3, 2021, in execution of the resolution of the Ordinary Shareholders’ Meeting of April 22, 2021, at the service of the Company’s incentive plan called “IWB SpA Incentive Plan 2020-2022”.

In the context of this Program, between 5 January and 3 March 2022 were purchased altogether 36,192 IWB treasury sharesfor an average price of € 39.50 per share and a countervalue overall of 1,429,628.50 euros, in accordance with and within the terms of the resolution of the aforementioned Shareholders’ Meeting. The transactions were carried out by the intermediary appointed in accordance with the legislative and regulatory provisions.

On 8 April, considering the above purchases and taking into account the shares already in the portfolio, the Company holds a total of 42,284 treasury shares in the portfolio, equal to 0.48% of the relative share capital. The subsidiaries of IWB do not hold shares in the parent company.

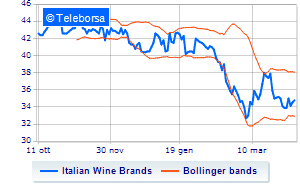

In Piazza Affari, today, modest income for Italian Wine Brandswhich is slightly up + 0.72%.