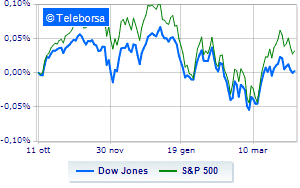

(Finance) – Last session of a weak week for the US price listwith the Dow Jones which stands on the eve of 34,584 points, while, on the contrary, theS & P-500, which loses 0.29%, trading at 4,487 points. Negative on Nasdaq 100 (-0.89%); on the same line, below parity theS&P 100, which shows a decrease of 0.40%. Investors’ focus remains on the prospects of one more restrictive monetary policy by the Federal Reserve. “Monetary policy remains very accommodative and delays in policy transmission indicate that the Central banks have found themselves behind the curvetherefore having to hasten the withdrawal of the political stimulus – commented Mark Dowding, CIO of BlueBay – This explains the imperative to anticipate the tightening, but by sharply exacerbating the risk is that the economy could slow down just as suddenly “.” Therefore, the likelihood of a recession in 2023 or 2024 seems to be taking holdhaving appeared very unlikely just a few months ago when we thought we would see a prolonged and more gradual cycle of Fed rate hikes, “he added.

Featured on the North American S&P 500 i price list compartments power (+ 1.96%), materials (+ 0.69%) e utilities (+ 0.44%). In the list, the sectors informatics (-1.05%), secondary consumer goods (-0.82%) e telecommunications (-0.51%) are among the best sellers.

Between protagonists of the Dow Jones, Chevron (+ 2.29%), Travelers Company (+ 0.93%), DOW (+ 0.89%) e United Health (+ 0.81%).

The strongest sales, on the other hand, show up on Boeingwhich continues trading at -1.34%.

Under pressure Applewhich shows a drop of 1.09%.

Modest descent for Visawhich yields a small -0.97%.

Thoughtful Intelwith a fractional decline of 0.93%.

On the podium of the Nasdaq titles, Crowdstrike Holdings (+ 4.02%), Constellation Energy (+ 3.30%), Regeneron Pharmaceuticals (+ 2.24%) e Modern (+ 1.60%).

The strongest falls, on the other hand, occur on Atlassianwhich continues the session with -7.73%.

Bad performance for Nxp Semiconductors NVwhich recorded a decline of 3.96%.

Black session for Zoom Video Communicationswhich leaves a 3.56% loss on the table.

At a loss Seagenwhich falls by 2.84%.

Between the data relevant macroeconomics on US markets:

Friday 08/04/2022

4:00 pm USA: Wholesale stocks, monthly (expected 2.1%; previous 1.1%).