The population in Sweden in 2023 amounted to over 10.5 million people. During the same year, there were a total of 2.3 million pensioners around the country.

In other words, thousands of people retire annually. And when it comes time to plan for life after work, there are several important parts to consider.

Those who choose to retire earlier than the target age, which is now 67, need to create good financial conditions. Therefore, having your own pension savings is good as it can hopefully result in financial security over time.

READ MORE: Retirement before 65? Then you should do this

Pension? Don’t forget to apply for this

Regardless of when you choose to retire, there is also another thing that is important not to miss, namely submitting the application to have the public pension paid out.

In an earlier interview with News24 has the pension economist Dan Adolphson Björck said that the general pension part is something you have to apply for on your own as there are no automatic payments of that part.

READ MORE: Don’t forget to apply for this – before you retire

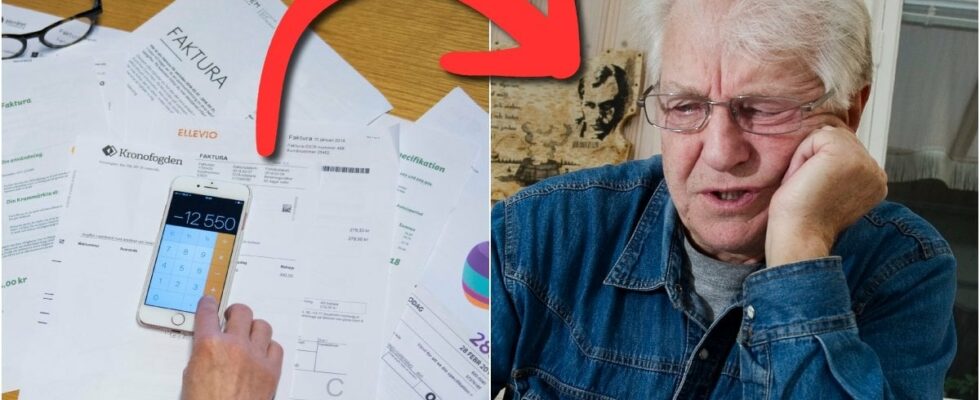

Photo: Pontus Lundahl/TTAre you planning your retirement? Then think about this

You who are now approaching retirement and thus starting to plan for a life as a pensioner should also think about three other important things, in addition to applying for public pension.

At the Pensions Authority homepage Namely has the pension informant Jörgen Brännmark shared tips to take into account before you start drawing your pension.

First of all, you should keep an eye on the size of your future pension. By making several pension forecasts, you get the best overview of the whole.

If you have turned 54, the recommendation is instead to look at the withdrawal planner, where you have the opportunity to save and compare different pension plans that you can create yourself. The planner also enables you to keep track of all current amounts after tax has been deducted.

In conclusion, it is also not a bad idea to consider working for a while longer, if the possibility exists. Namely, it can mean a couple of thousand extra in pension payments.

DON’T MISS: The pension detail you can’t miss – could cost you money

There are several important things to consider before choosing to retire. Photo: Janerik Henriksson/TTPensionsmyndigheten: The risks you should know

The authority’s pension informant emphasizes that there are also risks, above all when it comes to drawing an occupational pension for a shorter period.

The service pension can be withdrawn in as short a time as five or ten years. Brännmark therefore lists three things that are important for you to consider before you choose a shorter payment period for the occupational pension:

1. “The average life expectancy is increasing, which means that the pension money needs to last longer. Many people underestimate their own life expectancy, remember that you need financial security even in old age. When you take out the occupational pension for a short period of time, you will not be paid any more when that time has passed,” he writes.

2. “If you want to withdraw the pension for a short time to invest the money yourself, it can be good to know that the occupational pension is already invested, either in a so-called traditional insurance with low fees that gives a certain return or in funds that you have chosen yourself. A short payment period of the occupational pension compared to a lifelong payment means that you risk missing out on the increase in value that is not realized due to the interest on interest effect seen over a longer savings period. In the end, it can mean relatively large sums”.

3. “If you withdraw the occupational pensions in a short time, the monthly amount will be higher, it can lead to you crossing the cut-off point for state income tax and thus having to pay an unnecessary amount of tax,” Brännmarks concludes by writing.

DON’T MISS: The police warn: Fraud against pensioners is increasing

Family finances if you die

What financial protection do you have for the family? That’s a question you should ask yourself, says Brännmark.

He recommends you to review the financial protection you have for the family, maybe there is a possible survivor protection? If you do not have survivor protection, you will receive a higher pension, but your survivors will not receive compensation if you die.

READ MORE: 90-year-old woman deceived the fraudsters: “Hands in the cookie jar”