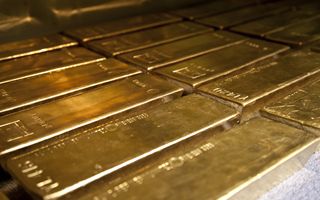

(Telestock) – Gold price rose above $2,500 an ounce for the first time on Friday afternoon, showing an increase of more than 20% since the beginning of the year, amid geopolitical uncertainties, expectations of interest rate cuts by the Fed and strong appetite from central banks.

The psychological threshold was broken by yellow gold, considered the safe haven par excellence, shortly before 4pm Italian time, at the end of a week in which they were several macroeconomic data released in the United States, which has strengthened its forecasts for an initial easing by the Fed (lower borrowing costs are positive for gold as it does not pay interest) and for a “soft landing” by the world’s largest economy.

In particular, the data for the month of July of the index of producer prices (released Thursday) and the index of consumer prices (released Wednesday) indicated that inflation is moderating, which could keep the U.S. Federal Reserve on track to begin its monetary easing cycle with a 25 basis point rate cut next month. In addition, the industrial production and the retail salespublished on Thursday and also referring to the month of July, confirmed the picture. On Friday it emerged that the new house construction in the United States fell in July to their lowest level since the pandemic, as manufacturers struggle with weak demand that keeps inventory levels high.

“We believe gold’s focus will remain firmly on the size and timing of the Fed’s likely move to cut rates,” commented Ewa Manthey, Commodities Strategist at ING – Geopolitics will also remain one of the key factors driving gold prices. The war in Ukraine and the ongoing conflict in Middle Eastalong with tensions between the United States and Chinasuggest that safe-haven demand will continue to support gold prices in the short to medium term.”

“The elections presidential November U.S. gold bullion will also continue to add to gold’s upside momentum through the end of the year, in our view, he added. central banks will continue to increase their holdings, which should provide support.”

Investors’ attention is now turned to the publication of the minutes of the previous Fed meeting and the words of Fed Chairman Jerome Powell on the US economy at the symposium Jackson Holeexpected next week.