The surprise announcement of the dissolution of the National Assembly by Emmanuel Macron on the evening of June 9th marked the start of a race against time, forcing political parties to hastily develop alliances, but also ad hoc programs. Some proposals are taken from the 2022 presidential campaign, others were pulled out of the hat for the occasion, sometimes with still vague outlines.

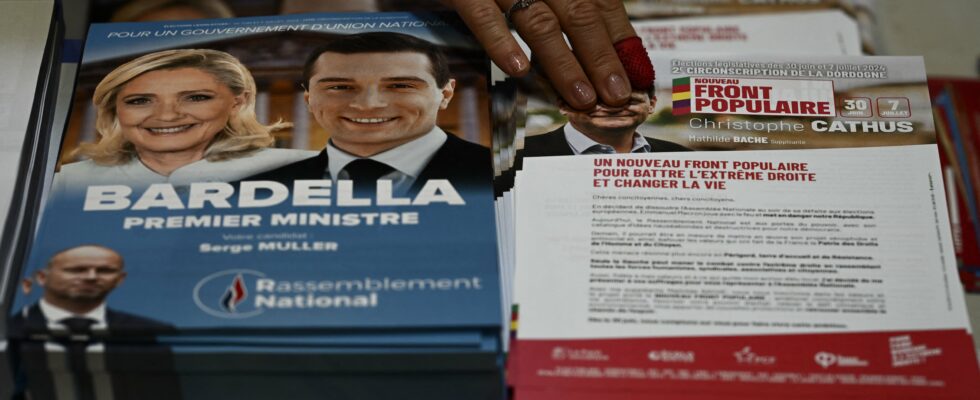

Among this avalanche of measures, beyond a questionable economic relevance, some appear impossible to implement, because they are contrary to the law. We have deciphered five of them, from the programs of the National Rally (RN) and the New Popular Front (NFP), the two forces that came out on top in the first round of the legislative elections.

Exiting free trade treaties: an agreement by a majority of the European Council is mandatory

The RN and the NFP agree on one point: the exit from free trade agreements. A promise that does not pass the test of reality. These agreements which aim to reduce, or even eliminate, customs duties on imported products are signed between the European Union (EU) and the countries or groups of countries concerned.

To revoke them, a decision by the European Council by qualified majority is therefore required: that is to say by 15 member states out of the 27, representing more than 65% of the population of the Union. However, today, none of the major countries – Germany, Poland, Italy or Spain – shares the French position. Worse, since 2017 and a decision by the European Court of Justice, trade agreements are now under the strict competence of the EU. No more need, therefore, for the approval of national parliaments for the signing of new treaties.

Reducing VAT on energy to 5.5%: possible for electricity and gas… but not for fuel

This is a flagship measure of the RN in terms of purchasing power: the reduction in VAT to 5.5% on energy products. In addition to being very costly – the estimated loss of tax revenue is around fifteen billion euros over a full year – and socially unjust since it benefits everyone, rich or poor, part of this promise is contrary to European law. Indeed, if fiscal sovereignty is one of the operating principles of the EU, it nevertheless has limits to avoid any form of distortion of competition.

According to Article 98 of the 2006 European directive on the common system of VAT, “the reduced rates shall apply only to the supply of goods and services of the categories listed in Annex III”. This famous annex includes foodstuffs, water distribution, pharmaceutical products, etc. Gas, electricity and fuel oil were later added. The problem is that fuel is not included. To do this, France would have to obtain a unanimous green light from the European Council, since it is a tax issue. Of course, the RN will always be able to argue that Poland applied a reduced rate on fuels between January 1 and July 31, 2022. A drop that was only temporary, and largely linked to the surge in oil prices at the time of Russia’s attack on Ukraine. However, today, the price of a barrel of black gold has fallen back.

In 2002, Jacques Chirac, who had promised during the campaign a reduced VAT in the restaurant sector, had to fight for months to obtain the go-ahead from the Brussels Commission, with Germany vetoing it. Given the budgetary cost of this proposal, it is unlikely that the “frugal” EU countries would again make this gift to a potential RN government.

Reducing France’s contribution to the European budget: no legal means of action

Not so long ago, in 2017, Marine Le Pen was still promising France’s exit from the EU. Five years later, if “Frexit” has disappeared from the RN program, anti-European overtones remain through certain measures. Like this desire to reduce the French contribution to the Union budget. The key: a planned saving of “two to three billion euros” – between 10 and 15% of the 21.6 billion euros that France has released in 2024.

In reality, Jordan Bardella would have no legal means of action to implement this proposal. The European budget is implemented on a multi-annual basis. The latest one was voted in 2021 and runs until 2027. Mid-term, a revision is possible, but the deadline has already passed. “He will only be able to make requests and prepare the next budget, but in the immediate future, he will not win his case,” points out economist Christian Saint-Etienne.

If the RN decides to overstep the rules, the consequences could be dramatic. “Three billion euros of savings to create a European crisis seems to me a dangerous bet,” estimates Jérôme Creel, director of the Studies department at the OFCE. Behind this measure is the desire of the far-right party to attack the founding principle of the EU. “The logic is bad. This puts an end to the very idea of a common budget,” judges Arnaud Schoenaerts, chief of staff of MEP Valérie Hayer.

Exempting under-30s from income tax: contrary to the principle of equality

This measure was already included in the RN’s program for the 2022 legislative elections. And as in 2022, the far-right party is carefully avoiding revealing the technical details. During the debate with Manuel Bompard on TF1, Tuesday, June 25, Gabriel Attal presented Jordan Bardella with a fait accompli, by raising the possibility that Kylian Mbappé (25 years old, and 72 million euros of income in 2024) would not pay tax, in the same way as an average taxpayer under 30. The party’s spokesperson, Sébastien Chenu, then began a first backpedal by mentioning the implementation of “ceilings” without further details.

In any case, this tax exemption would be difficult to apply under the Constitution. “All citizens must pay the same tax according to their income. Any exemption must be justified,” explains Michel Taly, former director of tax legislation. For now, the RN intends, with this exemption, to “promote their long-term settlement in France, professionally and family-wise”. In short: prevent them from going abroad. “Presented in this way, it poses a problem with regard to the principle of equality,” says a tax lawyer.

Added to this is the vagueness around the passage of young people into their thirties. “When we leave a favorable tax regime, there is always the problem of transition. We are forced to invent gas plants which add a little more complexity,” recalls Michel Taly. And for what effects? “This measure seems inappropriate to me, judges Jean-Philippe Delsol, president of the Institute of Economic and Fiscal Research. Few young people under 30 pay taxes. For those who earn a good living, there is no reason so that they do not contribute like others. What would we say if people over 70 were exempt from taxes?

Moving to 14 marginal tax brackets: a risk of unconstitutionality

The scale is not yet fixed but it is already shaking people. The New Popular Front plans to increase from 5 to 14 marginal tax brackets. The 90% rate on the last tax bracket, which appeared in Jean-Luc Mélenchon’s tax project in 2022, seems like a scarecrow. However, it is unlikely, especially since, as indicated by the Council of State in an opinion of March 21, 2013, “a maximum marginal tax rate of two-thirds, whatever the source of income, must be considered as the threshold beyond which a tax measure risks being censured by the constitutional judge as being confiscatory or as imposing an excessive burden on a category of taxpayers in disregard of the principle of equality.

For Xavier Magnon, professor of public law at Aix-Marseille University, “the excessive nature also depends on the income brackets decided. But even if we applied a rate of 90% to very high incomes, there would be a risk of unconstitutionality.” Especially since this project is accompanied by the increase in other taxes, with the reestablishment of an ISF which would include professional assets in the tax base – 15 billion euros per year in revenue at stake, according to the NFP, three times more than before its abolition in favor of the property wealth tax in 2018 -, and the reform of inheritance taxation, with the establishment of a maximum transferable amount of 12 million euros.

.