An insolent financial success. The semiconductor designer Nvidia became, on Tuesday June 19, the world’s largest capitalization on the stock market, overtaking Apple and Microsoft, a symbol of the fever of generative artificial intelligence (AI) which is shaking up the markets.

The market valuation of the Santa Clara (California) group rose to $3,352 billion, according to a calculation carried out by AFP. Around 6:30 p.m. GMT, Nvidia shares were up 3.69% on the New York Stock Exchange. “We’ve been waiting for this for a while,” reacted Angelo Zino, CFRA analyst.

“AI is changing the landscape. In the real world, but also in the markets,” he added, noting that the semiconductor industry was now the most important sector on Wall Street .

In the top 3 in the world

Nvidia remained slightly behind the absolute record reached the day before by Apple, at $3,376 billion. Now, Nvidia, Apple and Microsoft account for around 10% of all publicly traded companies in the world. Since the launch of ChatGPT in late November 2022, Nvidia’s stock price has increased eightfold.

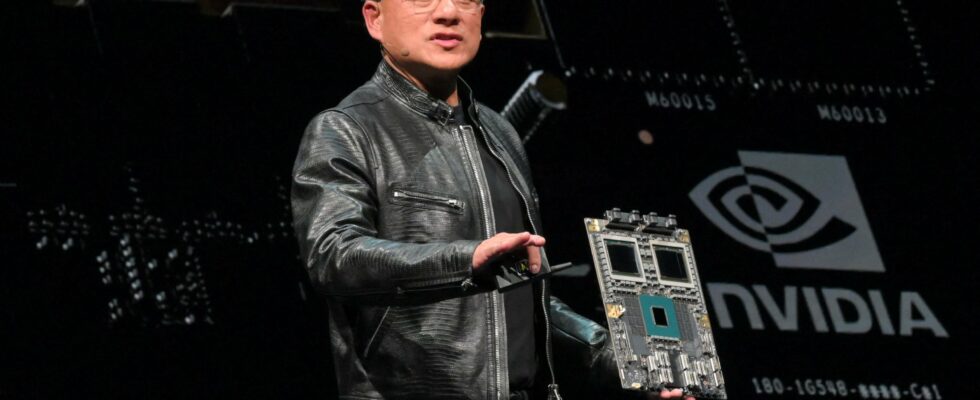

The recent split of the company’s shares by ten, on June 7, helped to further accelerate the increase in the stock’s price, making it more accessible to investors. The decline in bond rates also favors so-called growth stocks, including Nvidia. The group owes its popularity to its graphics cards (GPU), chips capable of handling a considerable amount of calculations, necessary for the development of generative AI programs.

Generative AI allows a user to obtain text, a photo, a video, lines of code or sound thanks to a request formulated in everyday language. To make this feature possible, developers accumulate billions of examples of conversations and writing to predict the best response to a request.

Even if its major competitors like AMD or Intel, as well as “tech” giants like Apple or Microsoft, are chasing it, Nvidia maintains a comfortable lead in the market for semiconductors used for generative AI. The company even accelerated the pace by presenting a new processor at the beginning of June, less than three months after the introduction of the previous model, in a sector historically accustomed to spacing its releases several years apart.

Towards 4,000 billion?

“Nvidia’s GPU chips are the new gold or oil of the technology sector,” say analysts at Wedbush Securities. For them, Nvidia, Apple and Microsoft are now engaged in “the race for 4,000 billion dollars in market valuation”.

For a quarter of a century, General Electric, Cisco, ExxonMobil, Microsoft and Apple have succeeded one another on the top step of world capitalization, before the coronation of Nvidia. “On Wall Street, to which investor capital is currently flowing, Magnificent Seven continue to dominate trading,” commented Konstantin Oldenburger, analyst at CMC Markets, in reference to the seven giant capitalizations in the technology sector, which have been driving the indices for 18 months.

“Nvidia is the company that creates the most value in the world at the moment. There is no denying it,” said Adam Sarhan, analyst at 50 Park Investments, mentioning generative AI, but also computers and the cryptocurrency industry.

Asked to compare Nvidia’s trajectory to the rise of the technological flagship Cisco which, in the spring of 2000, had risen, briefly, to first place in world capitalizations, Adam Sarhan recalls that “it was the peak of the internet bubble. “But here, this is only the beginning of the AI boom,” notes the manager.

After having equipped servers around the world to build and run generative AI software, new generation chips, those from Nvidia in the lead, will slip into individual devices, smartphones and computers in particular, anticipates Angelo Zino. They will also be in demand in the industrial sector, as well as that of autonomous vehicles, continues the analyst: “These are massive opportunities for Nvidia.”