(Finance) – The Wall Street stock exchange continues in red while inflation in the United States continues to rise. In fact, in February, the preferred size of the Federal Reserve the PCE figure (Personal consumption expenditures price index), grew by 6.4% compared to a year earlier, the highest figure since 1982. In the meantime, investors await concrete developments in the negotiations between Russia and Ukraine to reach an agreement at least on the ceasefire.

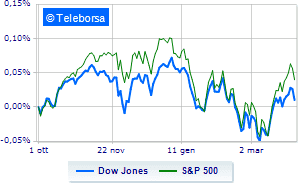

Among the US indices, it moves below parity on Dow Jones which drops to 35,054 points, with a percentage difference of 0.50%; on the same line, with a slight decrease inS & P-500, which continues the day below par at 4,584 points. Just below parity the Nasdaq 100 (-0.55%); with a similar direction, under parity theS&P 100which shows a decrease of 0.56%.

The sector is in good evidence in the S&P 500 utilities. Among the worst on the list of the S&P 500, the sectors showed the greatest decline telecommunications (-1.12%), financial (-0.79%) e secondary consumer goods (-0.75%).

At the top of the ranking of American giants components of the Dow Jones, Cisco Systems (+ 1.01%), Merck (+ 0.67%), Amgen (+ 0.63%) e Caterpillar (+ 0.60%).

The strongest falls, on the other hand, occur on Walgreens Boots Alliancewhich continues the session with -5.06%.

Breathless Intelwhich falls by 2.57%.

Thud of Home Depotwhich shows a fall of 2.17%.

Decline for JP Morganwhich marks a -1.81%.

To the top between tech giants of Wall Streetthey position themselves Datadog (+ 2.83%), Booking Holdings (+ 2.41%), Crowdstrike Holdings (+ 2.33%) e Vertex Pharmaceuticals (+ 2.33%).

The worst performances, on the other hand, are recorded on Advanced Micro Deviceswhich gets -7.70%.

Letter on Pinduoduo Inc Spon Each Repwhich records a significant decline of 7.37%.

Goes down Baiduwith a fall of 7.02%.

Collapses JD.comwith a decrease of 5.45%.

Between macroeconomic variables most important in the North American markets:

Thursday 31/03/2022

13:30 USA: Challenger layoffs (previous 15.25K units)

14:30 USA: Personal income, monthly (expected 0.5%; previous 0.1%)

14:30 USA: Personal expenses, monthly (expected 0.5%; previous 2.7%)

14:30 USA: Unemployment Claims, Weekly (197K Expected; Previously 188K Units)

15:45 USA: PMI Chicago (expected 57 points; preceding 56.3 points).