(Finance) – Discount for Advanced Micro Deviceswhich trades at a loss of 8.11% on previous values.

The cut in judgment at the hands of Barclays contributes to weighing on the shares of the chip giant. The analysts of the research department have revised the recommendation downwards, bringing it to “equal-weight” from a previous “overweight”.

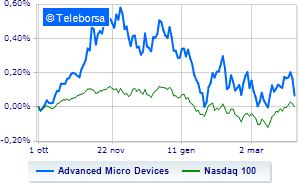

The technical scenario seen at one week of the stock compared to the index Nasdaq 100highlights a slowdown in the trend of US multinational semiconductor manufacturer compared toUS technology stock indexand this makes the stock a potential target for sale by investors.

The medium-term technical implications are always read in a bullish key, while in the short term we are witnessing a weakening of the bullish thrust due to the obvious difficulty in proceeding above USD 114.2. The most immediate support level to control the current phase seen in area 107.1 is always valid. The most consistent expectations are for an extension of the corrective movement towards 104.6 to be manifested in a reasonably short time.