(Finance) – Slips Walgreens Boots Alliance which presents a very bad -5.42%.

The pharmaceutical distributor closed the second quarter with a net profit down 13.9% to $ 883 million, or $ 1.02 per share, from $ 1.03 billion ($ 1.19 per share) in the same period a year ago. Excluding one-off bills, EPS is $ 1.59 higher than analysts’ estimate of $ 1.40.

THE revenues they grew to $ 33.7 billion from the previous year’s $ 32.7 billion and above the consensus’s $ 33.4 billion.

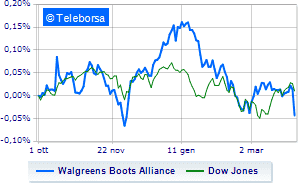

The technical scenario seen at one week of the stock compared to the index Dow Joneshighlights a slowdown in the trend of Walgreens Boots Alliance compared toAmerican indexand this makes the stock a potential target for sale by investors.

The short-term technical picture of Walgreens Boots Alliance shows an upward acceleration of the curve with a target identified at USD 45.54. Risk of descent to 44.2 which will not affect the good health of the current trend but which represents a temporary correction. Expectations are for an extension of the uptrendline towards 46.88.