(Finance) – The main stock exchanges of the Old Continent were all positivebenefiting from the optimism on the negotiations in Turkey, pending the departure of Wall Street and data on consumer confidence.

Slightly raised seat for theEuro / US dollar, which advances to 1.104. Sitting in fractional reduction for thegold, which for now leaves 0.42% on the parterre. Oil (Light Sweet Crude Oil), on the rise (+ 1.21%), reaches 107.2 dollars per barrel.

Small step to the top of the spreadwhich reaches +154 basis points, showing an increase of 2 basis points, with the yield of the 10-year BTP equal to 2.21%.

Among the main European stock exchanges flies Frankfurtwith a marked increase of 1.69%, London advances 1.24%, and shines Pariswith a strong increase (+ 2.37%).

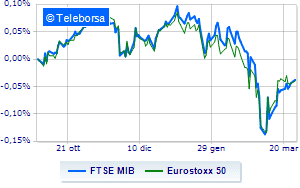

In Milan, the FTSE MIB (+ 1.77%), which reaches 25,151 points, continuing the positive streak that began last Thursday; along the same line, the FTSE Italia All-Sharewhich continues trading at 27,443 points.

Excellent performance of the FTSE Italia Mid Cap (+ 1.56%); on the same trend, in money the FTSE Italia Star (+ 1.39%).

Among the best Blue Chips of Piazza Affari, excellent performance for DiaSorinwhich records a progress of 5.07%.

Exploit of Amplifonwhich shows a rise of 4.19%.

High Unicredit (+ 4.19%).

Shopping hands-on Monclerwhich boasts an increase of 4.04%.

The strongest sales, on the other hand, show up on Ternawhich continues trading at -2.94%.

Suffers Saipemwhich shows a loss of 1.80%.

Prey of the sellers Snamwith a decrease of 1.32%.

Sales focus on Leonardowhich suffers a decline of 1.20%.

Top of the ranking of mid-cap stocks from Milan, Safilo (+ 6.31%), Buzzi Unicem (+ 4.96%), Saint Lawrence (+ 4.89%) e OVS (+ 4.72%).

The strongest sales, on the other hand, show up on Cattolica Assicurazioniwhich continues trading at -1.79%.

Sales on Antares Visionwhich recorded a decrease of 1.52%.

Negative sitting for Sesawhich shows a loss of 1.46%.

Under pressure Rai Waywhich shows a decrease of 1.21%.