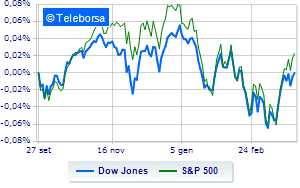

(Finance) – The New York Stock Exchange is hovering around parwith the Dow Jones which stands at 34,742 points; on the same line, theS & P-500, with the prices reaching 4,524 points. Slightly negative the Nasdaq 100 (-0.53%); on parity theS&P 100 (+ 0.04%). However, the US indices have worsened since the opening, dragged down by tech stocks, with Treasury sell-off continuing. Meanwhile, crude oil prices returned to rise following a drone attack on a Saudi Aramco site in Saudi Arabia.

Sectors stand out in the S&P 500 basket power (+ 1.74%), utilities (+ 0.99%) e financial (+ 0.96%). The sector Informaticswith its -0.57%, it is the worst of the market.

Between protagonists of the Dow Jones, Chevron (+ 1.36%), Travelers Company (+ 1.25%), Honeywell International (+ 1.19%) e IBM (+ 1.12%).

The strongest falls, on the other hand, occur on Salesforce.Comwhich continues the session with -1.64%.

Under pressure Home Depotwhich shows a decrease of 1.42%.

Undertone Microsoft which shows a filing of 0.74%.

Disappointing United Healthwhich lies just below the levels of the eve.

Between best performers of the Nasdaq 100, Dexcom (+ 2.39%), Constellation Energy (+ 1.80%), Exelon (+ 1.59%) e Intuitive Surgical (+ 1.40%).

The strongest falls, on the other hand, occur on Modernwhich continues the session with -8.62%.

Bad performance for Mercadolibrewhich recorded a drop of 5.65%.

Black session for Datadogwhich leaves a loss of 5.34% on the table.

At a loss Lucidwhich falls by 5.33%.

Among macroeconomic appointments which will have the greatest influence on the performance of the US markets:

Friday 25/03/2022

15:00 USA: Homes sales in progress, monthly (1% expected; previous -5.8%)

15:00 USA: University of Michigan Consumer Confidence (expected 59.7 points; preceded 62.8 points)

Monday 28/03/2022

14:30 USA: Wholesale stocks, monthly (previous 0.8%)

Tuesday 29/03/2022

15:00 USA: S&P Case-Shiller, annual (expected 18.4%; previous 18.6%)

15:00 USA: FHFA house price index, monthly (previous 1.2%).