The French central bank wants to be reassuring regarding real estate loans. In an interview given to Franceinfo on Wednesday March 13, the governor of the Banque de France, François Villeroy de Galhau, assured that banking establishments were once again more inclined to grant home loans to individuals.

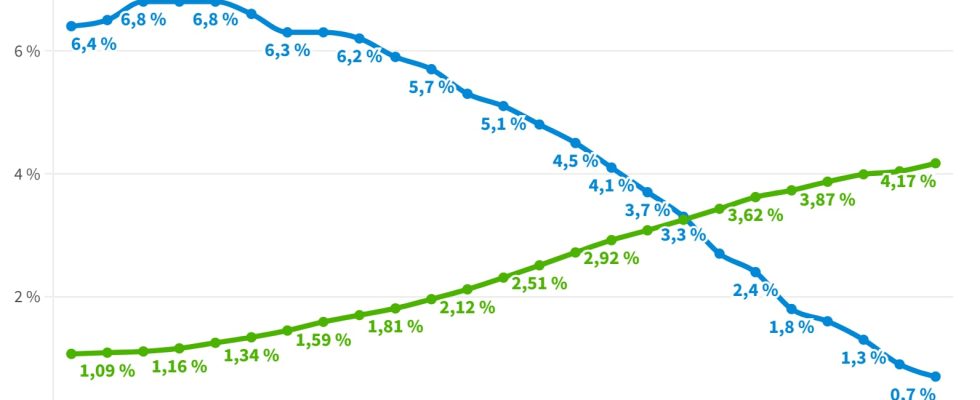

And this, while banks have never lent so little since 2015, according to the cumulative annual volume of real estate loans granted in 2023. A trend which continues today: according to the latest figures from the Banque de France, the annual growth rate of new loans granted to French households slowed again in January, to 0.7% over 12 rolling months, compared to 0.9% in December. A level not seen since 1996. This situation is mainly linked to the rapid rise in interest rates since 2022, decided by the European Central Bank to try to contain inflation.

If these interest rates remain high – in particular for new real estate loans excluding renegotiations, estimated at 4.17% in January 2024, according to the Banque de France – François Villeroy de Galhau affirms that this low level of loans granted “n “is more a problem of credit supply.” He even invites the population to “go and test their banker”, while recalling that the Bank of France has “asked banks to set up a review procedure” for households who have seen their first request refused.

More generally, the governor of the Bank of France estimated that the difficulties of the real estate sector, “which was going very well” before 2022 when interest rates were at their lowest, were not only linked to “financing and credit”. He declared: “When the Prime Minister [parle] to simplify, to debureaucratize, I believe that there is really something to be done.”