(Finance) – It goes back a lot Stitch Fixwhich exhibits a negative percentage change of 18.90%.

The clothing retailer has worsened its 2024 outlook. The San Francisco group has reduced its revenue guidance for the entire fiscal year from 1.30-1.37 to 1.29-1.32 billion dollars, against the 1.35 billion expected by the market. For the third quarter of 2024 alone, which began at the end of January, estimates are 300-310 million dollars, against the consensus of 322 million.

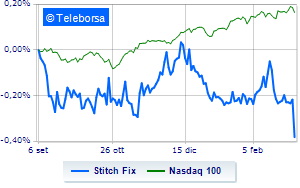

The one-week trend Stitch Fix is more sluggish compared to the trend of Nasdaq 100. This decline could trigger opportunities for the market to sell the stock.

The medium-term situation of Stitch Fix remains bearish. However, examining the short-term chart, it would be reasonable to begin to doubt the possibility of the bearish phase extending. An upward improvement in the curve is therefore expected, which encounters the first obstacle at 2.89 USD. Support seen at 2.49. Further bullish cues favor a new target estimated probably in the 3.29 area.