(Finance) – The indices of Piazza Affari and the other main European stock exchanges are all negativewith investors’ attention focused on the release of important macro data, arriving this week, for more indications on the timing of the next rate cuts by Fed and ECB. Therefore, numbers on American GDP and inflation in the USA and EU are awaited.

On the currency market, weak session for theEuro / US Dollar, which trades with a decline of 0.44%. Slight decline ingold, which falls to $2,025.50 per ounce. Oil (Light Sweet Crude Oil) lost 1.22%.

Unchanged spreadwhich is positioned at +144 basis points, with the yield on the 10-year BTP standing at 3.87%.

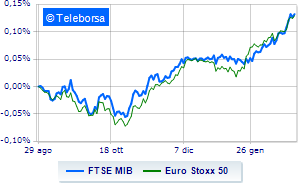

Among the European price lists cautious trend for Frankfurtwhich shows a disappointing performance of +0.1%. Londonwhich lies just below the levels of the day before, and is not very moved Paris, which shows -0.09%. In Milan, it moves below parity FTSE MIB, which drops to 32,568 points, with a percentage difference of 0.42%; on the same line, depressed the FTSE Italia All-Sharewhich trades below the levels of the day before at 34,699 points.

Between best Italian shares large cap, small steps forward for Unipolwhich marks a marginal increase of 1.10%.

Moderately positive day for MPS Bankwhich rises by a fractional +0.97%.

Sitting without momentum for Leonardoreflecting a moderate increase of 0.95%.

Small step forward for Telecom Italiawhich shows a progress of 0.70%.

The steepest declines, however, occur at STMicroelectronicswhich continues the session with -2.53%.

He suffers Nexiwhich highlights a loss of 2.22%.

Prey for sellers Campariwith a decrease of 2.01%.

They focus on sales Saipemwhich suffers a decline of 1.71%.

At the top of the mid-cap stocks ranking from Milan, D’Amico (+3.10%), Webuild (+2.09%), Caltagirone SpA (+1.24%) e Intercos (+0.82%).

The worst performances, however, are recorded on Technogymwhich gets -3.80%.

Sales up Tinextawhich recorded a decline of 2.72%.

Negative session for Ariston Holdingwhich shows a loss of 2.45%.

Under pressure Illimity Bankwhich suffered a decline of 1.90%.