Two years after the start of the war in Ukraine, the results remain mixed on the energy markets. On the one hand, the price madness has calmed down. The historic outbreaks that we experienced between February and June 2022 are nothing more than a bad memory. However, users benefit little from the lull because taxes are starting to rise again. At the same time, geopolitical risks could result in additional tensions. Another difficulty is that Europe seems to have invested too much in infrastructure used to transport liquefied natural gas (LNG) from Norway or the United States. Of course, it was necessary to get rid of the dependence on Russian gas. But the Old Continent’s growing overcapacity risks being costly, warns Edouard Lotz, market and energy analyst at the consulting firm Omnegy.

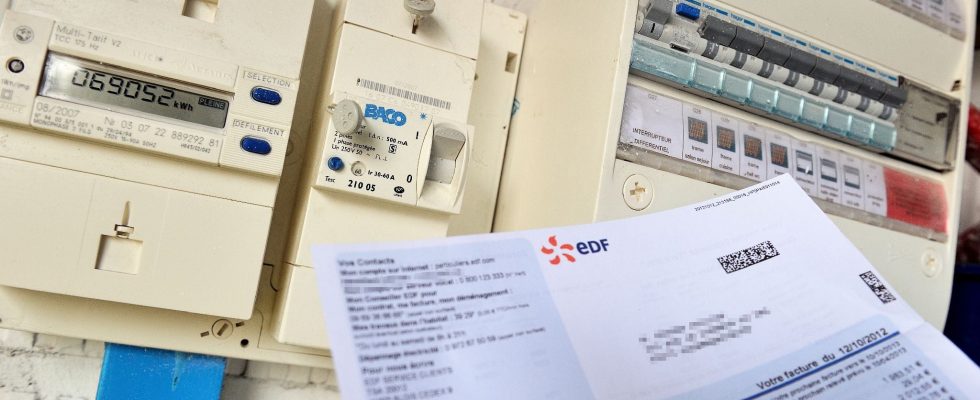

L’Express: Electricity taxes are on the rise again. For gas too, the bill is rising. Is this the start of a lasting trend?

Edouard Lotz: Indeed, the increase in gas prices has not been widely publicized. The internal tax on natural gas consumption (TICGN) has however doubled, going from 8.40 euros per megawatt hour to more than 16 euros. Why such a rebound? You should know that due to the 2022 crisis and the subsequent surge in prices, many consumers have abandoned gas for electricity. Result: the gas network has fewer users to finance maintenance costs. It is for this reason that the Energy Regulatory Commission (CRE) raised its benchmark price, on which suppliers base themselves. Second reason explaining the increase in taxes, the State has taken responsibility for numerous expenses since Covid with the tariff shield. The time has now come for cost savings and the search for new recipes. The period is particularly suitable as energy prices have fallen significantly over the past 4 or 5 months. Consumers can therefore more easily absorb the additional cost induced by the tax increase.

On the electricity side, the same logic prevails. The internal consumption tax on electricity (TICFE) has returned to its pre-crisis level, around 22.50 euros per megawatt hour, after having been lowered to between 50 cents and 1 euro at a time when tensions on prices were the highest. The problem for consumers? This rebalancing will continue. A classic invoice is broken down into three blocks: the first concerns the price of the electron, the second the transport of energy and the third the taxes. Today, the cost indicated in the first block is rather downward. Conversely, that of the other two increases. This configuration should continue over the next two or three years.

What about geopolitical risks? To what extent can they disrupt markets?

The threats are increasing. Russia still supplies 15% of European gas needs. It would be enough for the international situation to worsen, following new economic sanctions against Moscow, or sabotage of a pipeline in the Baltic Sea, for the markets to become tense again. In the Red Sea, we can see that many LNG carriers and tankers avoid going through the Suez Canal. They prefer the Cape of Good Hope, despite the lengthening of the journey and therefore an increase in transport costs. Finally, the Biden administration is currently conducting a major audit of its LNG sector, which could result in slowing down or stopping the construction of new terminals planned in Europe. By 2026, we could therefore see a further increase in the gas markets due to reduced supply capacity.

Of course, the decline in the appetite of gas users in Europe (-20% compared to 2021) gives us some room for maneuver. But not a lot. A few months ago, a simple strike at a production site in Australia was enough to cause a rebound in prices. And for good reason: there is international competition for the same resource. If, for example, Australian gas becomes less available to Asia, it shifts to other supplier countries which usually deliver gas to Europe. This then causes a rise in prices on the Old Continent. We must therefore be vigilant again this year. Because the slightest problem or unforeseen event could disrupt the markets.

Another important point, the geopolitical risks that we have just cited also apply to the electricity market. In fact, the slightest increase in gas prices automatically increases the production cost of the power plants that produce it. However, this serves as a reference for the wholesale price of electricity within the EU because the system first calls the production units with the lowest operating costs – renewable and nuclear –, then last Instead, the power plants with the highest costs, in this case those running on gas and coal. The conflicts which threaten gas prices therefore also threaten electricity prices.

By wanting to get rid of its dependence on Russian gas, has Europe not invested too much in LNG?

Indeed, the figures show it. Since February 2022, eight LNG regasification projects have been built in Europe, adding 53.5 bcm – billion m3 – of capacity, a jump from 257 to 310 bcm. However, LNG demand on the European continent is expected to peak at 169 bcm in 2025, before gradually decreasing in the following years. We therefore have a situation in which Europe continues to build import infrastructures, even though these far exceed needs.

We are already seeing the effects on the average utilization rate of European terminals, this showed 59% in 2023 compared to 63% in 2022. This rate is expected to further deteriorate in the future, as import capacities increase and demand for LNG decreases . It could fall to around 30 to 35% by 2030, thus leaving a vast majority of gas processing infrastructures out of use. Let us be clear, this is not to say that LNG is a bad choice. Faced with the energy crisis, Europe urgently sought alternative solutions and the first that emerged was to build a robust network for this type of gas. Simply, the bill promises to be hefty because in this matter, we have obviously thought too big.

.