(Finance) – Wall Street was weak on the day the quarterly reporting season began and in the aftermath of the drop due to the disappointing data on American inflation, which rose slightly more than expected in December. Today, however, producer prices surprisingly fell, fueling investors’ hopes of rate cuts by the Fed in March.

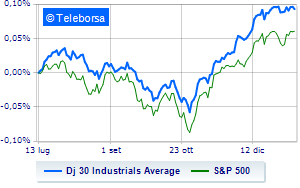

In New York, it moves below parity Dow Joneswhich drops to 37,528 points, with a percentage difference of 0.49%, while theS&P-500, which remains at 4,776 points. On the levels of the day before the Nasdaq 100 (-0.1%); as well as consolidates the levels of the day beforeS&P 100 (-0.05%).

Power (+0.85%), utilities (+0.75%) e telecommunications (+0.66%) in good light on the S&P 500 list. In the list, the worst performances are those of the sectors secondary consumer goods (-1.10%) e financial (-0.45%).

At the top of the rankings American giants components of the Dow Jones, Verizon Communications (+1.77%), IBM (+1.21%), Chevron (+0.95%) e Walt Disney (+0.88%).

The worst performances, however, are recorded on United Healthwhich gets -3.69%.

Under pressure Boeingwhich suffered a decline of 2.43%.

It slides Walgreens Boots Alliancewith a clear disadvantage of 1.87%.

In red Intelwhich highlights a sharp decline of 1.76%.

Between best performers of the Nasdaq 100, Cognizant Technology Solutions (+3.63%), Zoom Video Communications (+3.09%), MercadoLibre (+2.93%) e Regeneron Pharmaceuticals (+1.35%).

The strongest sales, however, occur at Polishedwhich continues trading at -7.11%.

Letter about Tesla Motorswhich recorded a significant drop of 3.97%.

The negative performance of IDEXX Laboratorieswhich falls by 3.65%.