(Finance) – Wall Street has moved little and is set to end the week in declineafter a better-than-expected U.S. jobs report signaled labor market resilience and lowered investor expectations for rapid interest rate cuts by the Federal Reserve.

According to data released by the Department of Labor, 216 thousand were added jobs in the non-agricultural sectors (non-farm payrolls) in December 2023, after 173,000 payrolls were created in November, and compared to market expectations for an increase of 170,000. The unemployment rate remained stable at 3.7%, compared to expectations for a 3.8% increase.

Today’s data, added to the minutes of the latest Fed meeting, has reduced expectations of a rate cut. According to the CME FedWatch Tool, traders see a 57.6% probability for a cut of at least 25 basis points in Marchdown from 73.3% a week ago.

Between company news, Tesla recalled more than 1.6 million cars in China due to problems with the driver assistance system, Allogene Therapeutics decided to cut 22% of the workforce and Constellation Brands confirmed EPS guidance after quarterly results.

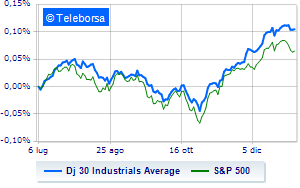

Looking at the main Wall Street indicesThe Dow Jones it is substantially stable and stands at 37,428 points; along the same line, theS&P-500, which continues the day at 4,695 points. On the levels of the day before the Nasdaq 100 (+0.14%); slightly positiveS&P 100 (+0.22%).