The numbers speak for themselves. In old real estate, prices fell by 1.8% in the third quarter year-on-year, according to the benchmark Notaires-Insee index published on November 30. Prices fell by 1.6% for houses and 2% for apartments.

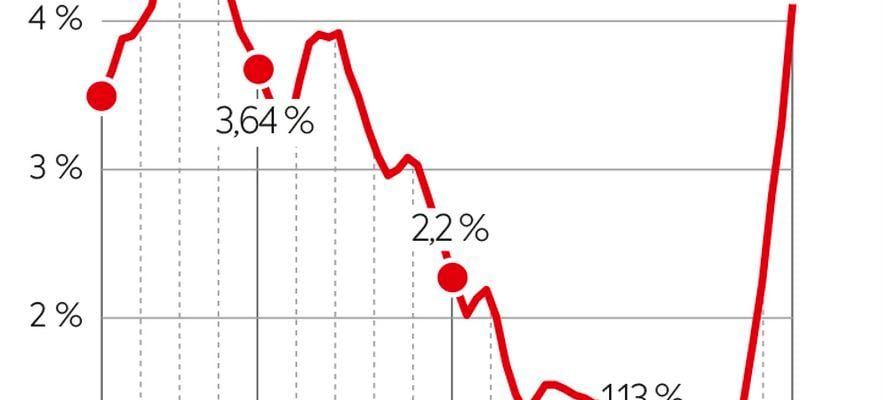

The rise in prices, which has continued since the end of 2015, therefore marks a clear slowdown since mid-2022, when it still exceeded 6% per year. From + 6.8% in the second quarter of 2022, the increase in prices in old real estate fell to 6.4%, 4.6%, 2.7%, then 0.5% in the second quarter, before this fall. by 1.8% year-on-year in the third quarter.

Laforêt Immobilier also notes this trend. In September 2023, at the national level, the decrease was 3.1% compared to the same month last year. “The drop in prices is spreading throughout France while remaining insufficient to rehabilitate buyers,” noted this network of real estate agencies. Ile-de-France is particularly affected, with a drop in prices of 6.4% compared to September 2022.

For Guy Hoquet, another network of real estate agencies, the drop in prices is around 1.4%. “It remains very relative for the moment”, however, relativizes to L’Express Delphine Herman, director of external relations and transversal projects. Few places are spared. Thus, the seaside resorts of La Baule and Pornichet (Loire-Atlantique), where the market still remains dynamic, show prices falling by 3 to 5% on the seafront and in the residential areas, notes the agency. Real estate evidence, located in these two municipalities.

The surge in rates

This drop is mainly linked to the surge in interest rates, which has increased the cost of credit. “In the first half of 2022, we could borrow at rates around 1%. In 18 months, the cost of money increased very sharply because the rates happily exceeded 4%,” recalls L ‘Express Yann Jéhanno. However, notes the president of the Laforêt network, prices are not “going downhill”. “Buyers, who have seen their purchasing power decline by 20 to 25% depending on the territories and profiles, want to recover part of this purchasing power lost in prices,” he indicates.

3778 housing rate real estate credit individuals

© / Art Press

“The combined effect of the loss of purchasing power of the French and the sudden rise in mortgage rates has generated this contraction of the market. Fewer potential buyers for the same property, this reverses the balance of power on the value of the property”, adds Delphine Herman.

Most sellers have adapted to this new situation. “In the first quarter of 2023, sellers quickly understood that the market was a little less favorable to them and that it was in their interest to take a step to lower prices. They did so quite voluntarily and significantly, explains Yann Jéhanno . Then, over the following six months, it was the buyers who made efforts and reconfigured their projects.”

More important negotiations

“Sellers are starting to understand that the party is over,” notes Vincent de Béjarry, sales manager at Evidence Immobilière. He recalls that the market boomed in 2020 and 2021, in the midst of a health crisis. “We experienced a truly abnormal period where, as soon as we put a property online, even with a price set 5 to 10% above the estimate, we immediately had 15 requests and we had to visit it right away. At that time, if buyers didn’t make an offer at the price, the property would pass them by,” he says.

In this context, goods for sale are subject to increased negotiations. “They have always occurred but have increased. They are much stronger in October and November compared to the start of the year,” underlines Yann Jéhanno. The president of the Laforêt network indicates that if the trading margin was around 4.5% in the first half of 2022, when the market was operating at full speed, it is now around 6% at the national level at the end of this year . The proportion of goods traded has also increased, from six out of ten goods before 2022 to almost eight out of ten goods now.

“Sellers have an interest in being reasonable when they have buyers who are financeable,” he says. “The balance of power between sellers and buyers is starting to change. It’s a profound change compared to the market that we have experienced over the last 10 or 15 years,” observes Delphine Herman. Yann Jéhanno qualifies: “The buyers must already be financeable and be able to demonstrate it.” Vincent de Béjarry’s agency “immediately checks the solvency” of the buyer, now asking him “systematically to go see a broker so that he can give them a certificate of solvency”.

The situation therefore changed in 2023. “For six to eight months, we have no longer had any offers at the price whereas we had them quite regularly in 2021. The prices of the property are negotiated during each sale and First-time buyers sometimes do not hesitate to make offers 20 or 25% below the price in Saint-Nazaire”, a more popular town near La Baule, testifies Vincent de Béjarry.

However, some sellers are still reluctant to lower prices. “There are some who resist. We have to do a lot of teaching and monitoring,” says Yann Jéhanno. In all cases, “sellers have an interest in being reasonable when they have buyers who are financeable,” he says.

A drop in prices which is expected to continue

Will this downward price trend continue in 2024? Even if they prefer to be cautious, the real estate professionals interviewed believe it. Inflation, international conflicts… The context “means that we should continue with this dynamic of falling prices, at least during the first half of 2024”, predicts Yann Jéhanno. Another element mentioned by the president of the Laforêt network: protests in certain regions, particularly areas close to the coast, against price increases and the difficulties for locals to find housing. “We are seeing many historical inhabitants of certain regions regain control of their market. This helps to reduce prices a little.”

If the drop in prices should particularly continue in Ile-de-France, on the other hand, Brittany and Normandy remain two “attractive” regions which could continue to do well in the future. A trend reinforced by the fact that more and more retirees are leaving the south of France to settle in these regions, particularly due to global warming and flooding, notes Yann Jéhanno.

“I do not foresee an incredible first half of 2024. Real estate professionals will have to continue to sit back during the first part of 2024,” Jean-Baptiste Bullet tells L’Express. According to the spokesperson for the notaries of Greater Paris, the drop in prices “should smooth out”. Vincent de Béjarry also estimates that this decrease observed in 2023 will “continue slowly” next year, perhaps around 2 or 3%, even 5%. “I am not sure that a huge upheaval will occur, there will probably not be a collapse in prices,” predicts the sales manager of Evidence Immobilière.

A “new balance” between sellers and buyers

Asked by Le Figaro in October, Christian de Kerangal, general director of the Institute of Real Estate and Land Savings (IEIF), was more affirmative: “I don’t see how we can avoid an even more significant correction in prices . […] A drop in prices of at least 10% in France is likely over the next two or three years, with strong variations depending on the city. In Paris, where prices have risen significantly in recent years, these reductions could reach at least 15% to 20%,” continued Christian de Kerangal.

“For 2024, the outlook remains uncertain, says Delphine Herman. If economic conditions improve, as seems to be starting at the end of 2023, with a stabilization of credit rates and slowed inflation, I expect trading volume equal to or slightly lower than the 2023 landing. If this were the case, the price decline could continue, but with some form of deceleration.”

Yann Jéhanno nevertheless qualifies the impact of this drop: “Many municipalities find themselves in a shortage market with very few goods available for sale.” In addition, properties in the price range between 250,000 and 300,000 euros, the heart of the real estate market, should still be in demand according to him. “These properties are very sought after,” notes Yann Jéhanno, indicating that the average price of a real estate transaction at Laforêt is 267,000 euros.

“The year 2024 should probably see the establishment of a new balance between buyers and sellers,” declares Delphine Herman. “But the real issue remains that of supply with the structural insufficiency of new housing.” Guy Hoquet’s director of external relations and cross-functional projects is calling on the public authorities for a “proactive construction policy to meet the needs of the French”. “We are currently experiencing a real housing crisis, more dangerous than it seems,” she worries. And this crisis may not resolve quickly.

.