The Chinese probably feel like they are in a bad dream. Like the movie A day without end, released in 1993, in which actor Bill Murray relives the same day over and over again, history seems to repeat itself. At least it shows signs of déjà vu. The sudden increase, in recent weeks, in the number of respiratory diseases in the country is suffocating hospitals overwhelmed by the arrival of often very young patients. A situation that is once again critical for a population which has experienced three years of health restrictions due to Covid-19, even if Beijing assures that “no new pathogen” has been detected.

At the same time, asset manager Zhongzhi is worried. This conglomerate is under criminal investigation, the motive of which has not yet been revealed. Indebted to the tune of tens of billions of dollars, Zhongzhi manages corporate and household savings, but also holds several stakes in companies listed on the stock exchange. A new threat after the fall of the giant Evergrande, with a risk of financial crisis which would be added to an already devastating real estate debacle.

A horizon repeatedly pushed back

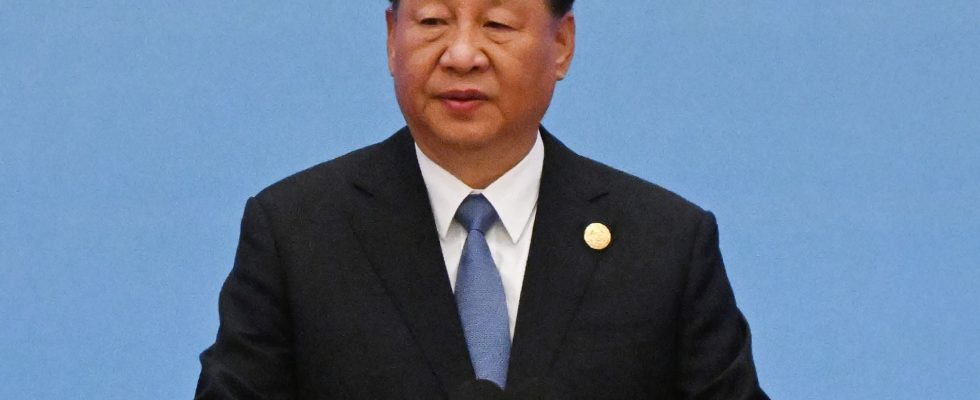

Faced with the slowdown in the Chinese economy, the government remains on guard. In the third quarter, Chinese GDP increased by 4.9% year-on-year, after 6.3% in the second quarter. However, growth remains the key word for Xi Jinping. And for good reason: the leader has set 2049 as the year in which his country will become the leading world power, at the expense of the United States. An important date since it is also the centenary of the People’s Republic of China.

This symbolic milestone, but so crucial for Chinese affairs, has been postponed many times. Firstly by economists, who mostly agreed in their forecasts for 2035. But in the meantime, Covid, the trade war with Washington and the conflict in Ukraine have passed by. “This case shows us the limits of very long-term economic forecasts,” underlines economist Claude Meyer, advisor to the Ifri Asia Center.

Today, this objective is losing credibility. “There is virtually no chance that China can truly close the gap with the United States in terms of per capita income. When it comes to nominal GDP, there is a window in which this could happen But as the years go by, this perspective becomes more distant,” said George Magnus, associate at the China Center at the University of Oxford. In 2022, Chinese GDP was estimated at $17,450 billion, compared to $25,462 billion for the United States. In any case, no more double-digit growth rates. “This was the result of catching up. There is a point where we have absorbed the growth capacity of the economy and where productivity decreases. Many countries have already been in this situation,” explains Mary-Françoise Renard, professor at Clermont-Auvergne University and specialist in China.

Demographics, consumption…

Several factors work against the ambitions of the Asian giant. First, its demographics are declining. In 2022, China lost 850,000 inhabitants, a first since the 1960s. “How is it that the Chinese government waited so long to change the one-child policy? The norm has become one child per household , despite all the efforts made and the incentives”, notes Claude Meyer. Second, the real estate sector is still struggling. “Very large bankruptcies threaten to take away a certain number of financial players which were created precisely to facilitate investments outside the banking framework, namely trusts. All this illustrates a very great fragility, despite the government’s attempts to clean up”, points out Jean-François Huchet, president of Inalco.

However, China still has ways to revive its economy. On the condition that she puts all the chances on her side. “We wonder why the Chinese government always relies on very conventional measures on infrastructure and real estate, when we know that there is an oversupply in these sectors. There would be much more effective measures , which require time and political will, to be put in place such as more social transfers or nets for youth unemployment”, lists economist Jean-François Huchet.

Consumption, at half mast since the health crisis, also needs a boost. “For this, a certain number of conditions are necessary, in particular household confidence. It has been undermined by Covid and the real estate crisis,” judges Mary-Françoise Renard. “What households do not invest in stone, they save. To revive consumption, the government should put in place a policy which consists of increasing wages, making transfers and increasing social protection “, adds the expert. A vast recovery plan will in any case be necessary. “If you look at other countries that went through China’s stage of development, like Japan and Canada, they all had to go through a period of political reform so that their institutions became more useful for economic development. “It’s simply a blockage that exists in China because of the Communist Party,” says George Magnus. An obstacle that is not about to be removed.

.