(Finance) – Strong rise for FootLockerwhich shows a burning rise of 16.23% on previous values.

The sportswear retailer provided a better-than-expected fourth-quarter outlook; sales on a comparable basis are expected to decline between 7% and 9% against the 10.5% decline expected by consensus.

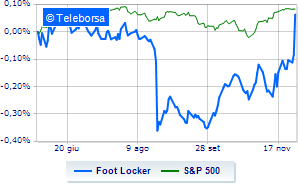

On a weekly basis, the stock’s trend is more solid than that ofS&P-500. At the moment, therefore, the appeal of investors is aimed more decisively at FootLocker compared to the reference index.

The short-term technical status of FootLocker highlights an expansion of the positive performance of the curve with the first area of resistance identified at USD 28.76. Risk of possible correction up to the 26.86 target. Expectations are for an increase in the bullish trendline towards the 30.67 resistance area.