(Finance) – The main Euroland markets are moving in positive territory. On the same bullish trail the FTSE MIB. In the morning it emerged that theinflation Spanish decreased in November 2023, also falling below analysts’ expectations, while at 2.00 pm the reading for Germany will also be released for the month of November.

It increases slightly confidence in the Eurozone economy in November 2023, according to data released by the European Commission. Istat instead reported that the business confidence climate in Italy fell for the fourth consecutive month, reaching the lowest level since April 2021, while the consumer confidence index, after four consecutive months of decline, began to increase again while remaining below the average level recorded in the period January – October 2023.

Slight decline inEuro / US Dollar, which falls to 1.098. No significant changes forgold, which trades on the day before at 2,037.9 dollars an ounce. Slight increase for petrolium (Light Sweet Crude Oil), which shows an increase of 0.73%.

It retreats slightly spreadwhich reaches +173 basis points, showing a small decrease of 2 basis points, while the yield of the 10-year BTP stands at 4.18%.

Among the Euroland indices well bought Frankfurtwhich marks a strong increase of 0.97%, without any improvements Londonwhich does not show significant changes in prices, and a positive balance for Pariswhich boasts an increase of 0.46%.

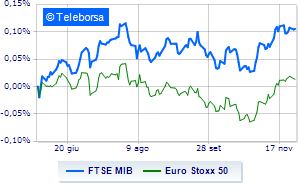

Positive session for the Milanese price listwhich shows a gain of 0.73% on FTSE MIB; along the same lines, the FTSE Italia All-Share it makes a small leap forward of 0.70%, reaching 31,550 points. Slightly positive FTSE Italia Mid Cap (+0.32%); as well, salt the FTSE Italia Star (+1.13%).

Between best performers of Milan, highlighted MPS Bank (+3.61%), DiaSorin (+3.22%), Stellantis (+2.67%) e Interpump (+2.40%).

The worst performances, however, are recorded on Campari, which gets -1.08%. Moderate contraction for Telecom Italiawhich suffers a drop of 0.72%.

Among the protagonists of the FTSE MidCap, OVS (+4.26%), Digital Value (+2.95%), Eurogroup Laminations (+1.83%) e LU-VE Group (+1.82%).

The worst performances, however, are recorded on SOL, which gets -3.38%. Undertone Buzzi Unicem which shows a filing of 0.96%. Disappointing Maire Tecnimont, which lies just below the levels of the day before. Lame Juventuswhich shows a small decrease of 0.56%.