(Finance) – Wall Street is little moved, but is preparing to close another week on the rise, after various data, including the consumer and producer price index, indicated an easing of inflationary pressures. Furthermore, data on unemployment benefits signaled a further cooling of the labor market, which is another factor in favor of end of the path of monetary tightening by the Fed.

The president of the Federal Reserve Bank of Chicago, Austan Goolsbee, said the U.S. central bank will “do what it takes” to get inflation back to the 2% target, noting that inflation already appears to be on that path if house price pressures ease as expected. Instead, despite the recent encouraging signs on inflation, the president of the Boston Federal Reserve, Susan Collinssaid further interest rate increases may still be needed.

Between quarterlyimportant signals continue to emerge from the giants of the world retail. Gap forecast flat or slightly negative sales in the Christmas quarter, after reporting better-than-expected results in the third quarter, while Ross Stores improved its guidance on annual profit, while maintaining a cautious approach in the face of many unknowns.

Today the macro agenda is rather sparse. The only indication received is that the American construction market grew more than expected in October, according to data on new construction sites started and building permits issued by the competent authorities.

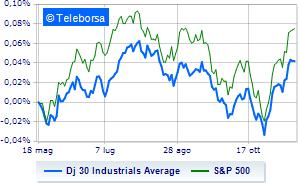

As for the main indicesWall Street reports a change of -0.04% on Dow Jones; on the same line, theS&P-500, with prices positioned at 4,509 points. Without direction the Nasdaq 100 (-0.14%); on the same trend, theS&P 100 (-0.13%).

In good evidence in the S&P 500 i compartments power (+2.37%), secondary consumer goods (+0.57%) e financial (+0.48%). At the bottom of the ranking, significant declines are evident in the sector telecommunicationswhich reports a decrease of -0.99%.

At the top of the rankings American giants components of the Dow Jones, Walgreens Boots Alliance (+2.10%), Chevron (+1.93%), Caterpillar (+1.85%) e American Express (+1.37%).

The strongest sales, however, occur at Nike, which continues trading at -1.62%. Thoughtful Amgen, with a fractional decline of 1.41%. He hesitates Microsoft, with a modest decline of 1.10%. Slow day for Procter & Gamblewhich marks a decline of 0.84%.

To the top between Wall Street tech giantsthey position themselves Ross Stores (+7.83%), Palo Alto Networks (+3.51%), Warner Bros Discovery (+3.39%) e Copart (+2.81%).

The worst performances, however, are recorded on Applied Materials, which gets -5.35%. He suffers Alphabet, which highlights a loss of 2.10%. Prey for sellers Alphabet, with a decrease of 2.05%. They focus on sales Polishedwhich suffers a drop of 1.75%.