(Finance) – Wall Street is weakwith investors awaiting a Crucial reading of US inflation and other economic data this week, which could impact expectations regarding how long the Federal Reserve will keep interest rates high. October data for US consumer prices will be released on Tuesday, and analysts are expecting 3.3% (year-over-year), up from 3.7% in the previous month.

Also weighing on investor sentiment is the fact that the rating agency Moody’s has confirmed the “AAA” on the United States, but issued a negative outlook: the reason is the widening of the deficit, currently at 6% of GDP and expected to rise to 8% in the coming years due to interest expenditure. With ten-year rates not expected to fall much, and from 4.5% in 2024 they should remain at around 4% in subsequent years as well, interest expenditure would go from 1.9% of GDP in 2022 to 4 .5% in 2033, while the federal debt would rise from 96% in 2022 to 120%.

Between securities under observation there is today Boeing, after Bloomberg reported that China is considering resuming purchases of 737 Max planes when the presidents of the United States and China meet this week at the APEC summit. Meanwhile, Emirates has ordered an additional 90 Boeing 777Xs when the Dubai Airshow opens.

Between quarterly published before the opening of the markets is that of Tyson Foodswhich released lower-than-expected revenue forecasts for the next fiscal year after falling chicken and pork prices and slowing demand for its beef products hurt fourth-quarter sales.

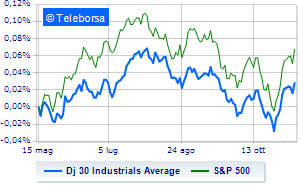

Looking at the main Wall Street indexes, the Dow Jones which stops at 34,240 points, while, on the contrary, theS&P-500, which continues the day below par at 4,397 points. Under parity the Nasdaq 100, which shows a decline of 0.60%; as well as the slightly negativeS&P 100 (-0.5%).

Among macroeconomic events which will have the greatest influence on the performance of the US markets:

Tuesday 14/11/2023

2.30pm USA: Consumer prices, annual (expected 3.3%; previously 3.7%)

2.30pm USA: Consumer prices, monthly (expected 0.1%; previously 0.4%)

Wednesday 11/15/2023

2.30pm USA: Retail Sales, Annual (previously 3.8%)

2.30pm USA: Production prices, annual (previously 2.2%)

2.30pm USA: Retail sales, monthly (expected -0.1%; previously 0.7%).