(Finance) – The stock is moving lower Chevron which changed hands at a loss of 5.91%.

The oil giant closed the third quarter of 2023 with a profit of 6.526 billion dollars, a sharp decline compared to 11.231 billion in the third quarter of 2022. Adjusted earnings per share stood at 3.05 dollars against 3.75 dollars of the LSEG consensus.

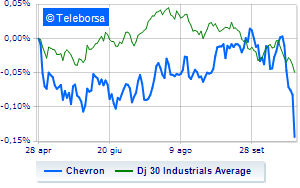

The technical scenario seen in one week of the stock compared to the index Dow Joneshighlights a slowdown in the trend of US oil giant compared toAmerican indexand this makes the stock a potential selling target for investors.

Analyzing the scenario of San Ramon oil giant there is a widening of the bearish phase at the test of the USD 143.4 support. First resistance at 149.5. Expectations are for an extension of the negative line towards new lows at 141.3.