(Finance) – A declining start for the Wall Street stock exchange with investor sentiment remaining focused on the evolution of the tensions in the Middle East. Eyes also on 10-year Treasury yield of the United States which exceeded 5%, for the first time since 2007, a psychological level that fuels concern that the surge in financing costs will erode economic growth.

In the background the quarterly season with accounts of America’s Big Techs due out this week: Microsoft, Alphabet, Meta, IBM, Amazon and Intel. For Apple’s quarterly report, however, we will have to wait for Thursday 2 November.

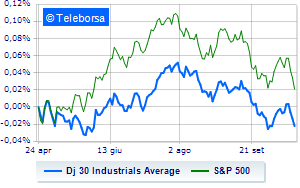

Among US indices, the Dow Jones the session continues with a decline of 0.54%, continuing the bearish trail of four consecutive declines that began last Wednesday; along the same lines, with a slight decrease inS&P-500, which continues the day below par at 4,205 points. Slightly negative Nasdaq 100 (-0.47%); along the same line, slightly decreasingS&P 100 (-0.46%).

All the S&P 500 sectors fell on Wall Street. Among the worst in the S&P 500 basket list, the sectors fell the most utilities (-1.39%), power (-1.14%) e materials (-0.87%).

At the top of the rankings American giants components of the Dow Jones, Merck (+2.23%) e Walgreens Boots Alliance (+1.43%).

The steepest declines, however, occur at American Expresswhich continues the session with -5.38%.

Under pressure Salesforcewhich suffered a decline of 2.20%.

It slides Intelwith a clear disadvantage of 2.10%.

In red JP Morganwhich highlights a sharp decline of 1.61%.

To the top between Wall Street tech giantsthey position themselves Walgreens Boots Alliance (+1.43%), O’Reilly Automotive (+0.97%), CSX (+0.72%) e Keurig Dr Pepper (+0.70%).

The worst performances, however, are recorded on Enphase Energywhich obtains -14.68%.

Thud of Zscalerwhich shows a fall of 4.07%.

Letter about Palo Alto Networkswhich recorded a significant drop of 3.96%.

The negative performance of Tesla Motorswhich falls by 3.69%.