(Finance) – Wall Street is at a losswith investors wondering about remarks by Federal Reserve Chairman Jerome Powell and on risks of an expansion of the Middle East conflict. The fact that the Treasury yield ten-year bond briefly exceeded 5% yesterday for the first time since July 2007, and stands today at 4.91%.

Yesterday, in a speech in New York, Powell offered ideas for everyone in terms of dovish and hawkish visions, leaving the possible need for further increases is open of rates because the economy turned out to be stronger than expected, but also underlining the emerging risks and the need to move with caution.

They are not here calendar data for today in the United States. Investors find themselves with a number of quarterly to be digested by major multinationals, including the numbers of American Express (third quarter growing thanks to sustained expenses), SLB (revenues and profits growing in double digits in the third quarter), Hewlett Packard Enterprise (disappointing outlook for 2024) e SolarEdge (profit warning due to weak demand in Europe).

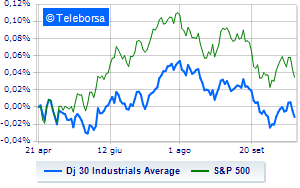

Looking at the main indicesThe Dow Jones it is leaving 0.34% on the floor, continuing the series of three consecutive drops that began last Wednesday; on the same line, theS&P-500, which slips to 4,248 points. Downhill the Nasdaq 100 (-1%); with similar direction, negative theS&P 100 (-0.72%).

They all slide onto the American S&P 500 list sectors. In the list, the worst performances are those of the sectors informatics (-1.29%), power (-1.13%) e secondary consumer goods (-1.13%).

To the top between giants of Wall Street, Merck (+2.49%), Walgreens Boots Alliance (+1.36%), Goldman Sachs (+0.91%) e Verizon Communications (+0.89%).

The worst performances, however, are recorded on American Express, which gets -3.82%. Negative session for Salesforce, which shows a loss of 1.84%. He hesitates Microsoft, which lost 1.30%. Basically weak Intelwhich recorded a decline of 1.30%.

On the podium of Nasdaq stocks, Warner Bros Discovery (+1.64%), Walgreens Boots Alliance (+1.36%), Keurig Dr Pepper (+1.28%) e Cognizant Technology Solutions (+1.19%).

The strongest sales, however, occur at Enphase Energy, which continues trading at -14.41%. Significant losses for Zscaler, down 4.23%. Breathless Atlassian, which fell by 3.96%. Under pressure Palo Alto Networkswhich suffered a decline of 3.77%.