(Finance) – The values for Piazza Affari are weak, while the other European markets are in sharp decline. It moves modestly downwardsS&P-500 on Wall Street, showing a decrease of 0.25%, after yesterday’s US inflation data which fueled speculation on longer-term higher interest rates by the Fed, while weak Chinese price data, released this morning , have increased fears about the global economy.

On the currency market, theEuro / US Dollar the session continues just below parity, with a drop of 0.26%. Decisive leap highgold (+2.78%), which reaches 1,920.9 dollars per ounce. Rain of purchases on oil (Light Sweet Crude Oil), which shows a gain of 4.49%.

Downhill it spreadwhich retreats to +190 basis points, with a decrease of 6 basis points, while the 10-year BTP reports a yield of 4.63%.

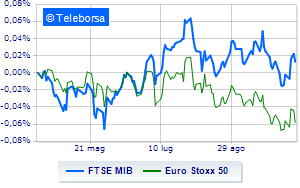

Among the Euroland indices collapses Frankfurtwith a decline of 1.55%, a modest decline for Londonwhich drops a small -0.59%, and slides Paris, with a clear disadvantage of 1.42%. A “bad” day for the Italian stock market, down 0.90% on FTSE MIB, thus ending the bullish streak supported by three consecutive gains, which began last Tuesday; on the same line, the FTSE Italia All-Sharewhich retreats to 30,040 points, retracing by 0.97%.

Among the best Blue Chips of Piazza Affari, well set out Tenariswhich shows an increase of 2.57%.

Toned Saipem which highlights a nice advantage of 1.83%.

Telecom Italia advances by 1.48%.

It is moving modestly upwards ENIhighlighting an increase of 1.32%.

The strongest sales, however, occur at Prysmianwhich continues trading at -5.00%.

In red Generali Bankwhich highlights a sharp decline of 4.47%.

The negative performance of Finecowhich falls by 3.45%.

Campari drops by 3.38%.

Between best stocks in the FTSE MidCap, Cementir (+1.83%), Ascopiave (+1.74%), Maire Tecnimont (+1.43%) e Intercos (+1.30%).

The strongest sales, however, occur at Secowhich continues trading at -8.26%.

Sales galore Replywhich suffers a decrease of 6.10%.

Bad performance for GVSwhich recorded a decline of 5.47%.

Black session for Ariston Holdingwhich leaves a loss of 4.18% on the table.