(Finance) – It moves upwards General Electric which changes hands exceeding the previous values by 3.61%.

The stock of the conglomerate celebrates board approval of a new $ 3 billion buyback plan. Last December, the company made a $ 23 billion buyback of its debt (with maturities up to 2050).

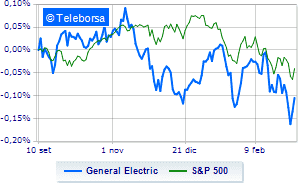

The trend of US multinational active in the technology and services sectors shows a trend in harmony with that ofS & P-500. This situation classifies the stock as a low alpha asset that generates no added value in terms of return compared to the benchmark index.

Analyzing the scenario of General Electric there is a widening of the bearish phase at the test of the USD 90.69 support. First resistance at 92.48. Expectations are for an extension of the negative line towards new lows at 90.05.