(Finance) – Wall Street moves lower and Treasury yields are on the rise after a jobs report signaled still tense conditions in the US labor marketfueling fears that the Federal Reserve could keep interest rates higher for a longer period.

In particular, the Department of Labor report showed that thenon-agricultural occupation And increased by 336,000 jobs in September, against market expectations for an increase of 170,000 units. Furthermore, the unemployment rate remained at 3.8% and wages increased at a modest pace.

These government data, along with others released in recent days such as the recovery in job supply, put pressure on Fed bankers to raise interest rates – already at 22-year highs – by another 25 basis points this year.

From the Federal Reserve, yesterday Mary Daly (San Francisco Fed) stated that monetary policy is in sufficiently restrictive territory and that a further rate increase may not be necessary if the progress recorded in the labor market and inflation continues in the coming months.

There are few indications quarterlywith Levi Strauss & Co – one of the world’s largest apparel companies – which lowered its full-year forecast after a disappointing quarterly.

Between companies affected by news There are Pioneer Natural Resources (the WSJ reported that ExxonMobil is currently in talks to buy it for about $60 billion), Tesla (which cut the prices of some Model 3 and Model Y versions in the US) and Philips (after the US Food and Drug Administration said its handling of the 2021 sleep apnea device recall was inadequate).

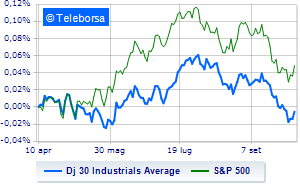

Looking at the main indicesthe US price list trades with a drop of 0.46% on Dow Jones; on the same line, theS&P-500, which relegates to 4,232 points. Negative changes for Nasdaq 100 (-0.74%); on the same line, just below parity theS&P 100 (-0.67%).