Paradigm shift. For decades, small and medium-sized listed companies, small & mid caps in stock market jargon, offered overall better stock market performance than the large groups. But, for five years, SMEs have no longer been as much of a dream for savers. Thus, over the past twelve months, the CAC 40 index posted a clear increase of 11%, while the CAC Mid & Small fell by around 2%.

Several factors explain this underperformance. “The tightening of central banks’ monetary policies, which took the form of a strong and sudden rise in key rates aimed at combating inflation, combined with expectations of recession, pushed investors to choose caution by favoring large companies “And all the more so since they have more liquid shares, due to greater trading volumes”, underlines Guillaume Buhours, analyst and fund manager at Gay-Lussac Gestion.

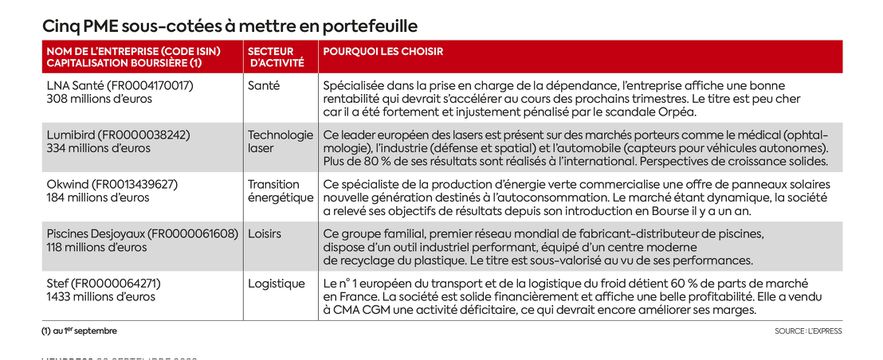

© / The Express

As a result, average values have returned to extremely low valuation levels (ratio between market capitalization and net profit), comparable to those observed in 2008. A strong signal for certain financial experts, according to which the time has come to acquire beautiful nuggets at attractive prices. “In the segment of small caps, there is a rich pool of listed companies, financially solid, profitable, headed by quality management, positioned in various fields of activity, and of European dimension. This is particularly the case for Beneteau, Séché environment and Mersen,” explains Régis Lefort, founding partner and fund manager at Talence Gestion.

Advantages linked to their size

SMEs benefit from advantages specific to their size and their organization: they are more reactive than multinationals, resulting in significant jumps in their results. Studies published by the private banks Oddo BHF and UBS, comparing 2024 to 2023, expect earnings per share growth of 47% on average for small companies compared to… 6% for large companies.

“Many small listed companies are positioned in innovative niche sectors with high barriers to entry, which allows them to be in a dominant position,” analyzes Guillaume Buhours. “They can thus generate growth in the long term. These are often family companies whose management is perfectly aligned with shareholders to create value. The icing on the cake is that they are regularly the target of purchase operations (takeover bids) which have a very favorable impact on their share price. Sotck exchange.”

However, due to lack of time and stock market experience, it is not always easy to choose these companies yourself. “If you have neither the expertise nor the desire to select these values yourself, invest in funds dedicated to small businesses managed by professionals, advises Régis Lefort. With these products, you pool the risk by promoting a necessary diversification.” A way to stimulate the development of SMEs while favoring local jobs.