(Finance) – Protagonist Intercept Pharmaceuticalswhich shows an excellent performance on Wall Street, with an increase of 78.59%.

Assisting the shares is the news that Alfasigma, one of the main Italian pharmaceutical companies, and Intercept Pharmaceuticals, a US biopharmaceutical company listed on the Nasdaq and active in the treatment of rare and serious liver diseases, have entered into a definitive merger agreement on the basis at which Alfasigma will acquire Intercept for $19 per share in cash.

The expected transaction will substantially expand Alfasigma’s gastrointestinal and hepatology portfolio and its presence in the US market.

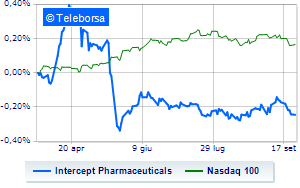

On a comparative level on a weekly basis, the trend of Intercept Pharmaceuticals highlights a more marked trend than the trendline of Nasdaq 100. This demonstrates the greater propensity of investors to buy towards Intercept Pharmaceuticals compared to the index.

New technical evidence classifies a worsening of the situation for Intercept Pharmaceuticals, with potential declines to the most immediate support area seen at USD 18.44. Sudden strengthening would instead undermine the above scenario with a bullish trigger and target on the most immediate resistance identified at 18.76. Expectations for the following session are for a continuation of the decline up to the important support positioned at 18.24.