(Finance) – Negative session for the Milanese price list, in contrast to the trend of the rest of the European stock exchanges, which instead trade at parity. The Wall Street stock market moves slightly higher with theS&P-500 which highlights an increase of 0.52%, while investors continue to question the moves of the central banks, in terms of monetary policy, protagonists this week.

On the currency market, little movedEuro / US Dollar, which trades on the day before at 1.066. L’Gold trading continues with a fractional gain of 0.43%. Slight increase in oil (Light Sweet Crude Oil) which rises to 89.98 dollars per barrel.

It goes up spreadsettling at +183 basis points, with an increase of 4 basis points, with the yield on the 10-year BTP equal to 4.57%.

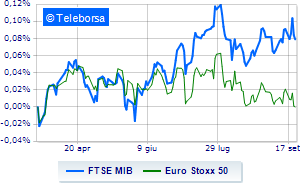

Among the markets of the Old Continent nothing done for Frankfurtwhich changes hands on parity, colorless Londonwhich does not record significant changes compared to the previous session, and a small loss for Paris, which trades at -0.4%. Weak session for the Milanese stock exchange, which trades with a drop of 0.46% on the FTSE MIB; on the same line, depressed the FTSE Italia All-Sharewhich trades below the levels of the day before at 30,458 points.

At the top of the ranking of the most important titles of Milan, we find Telecom Italia (+1.69%), Moncler (+1.66%), ENI (+1.48%) e Nexi (+0.93%).

The strongest sales, however, occur at Amplifonwhich continues trading at -4.27%.

In red MPS Bankwhich highlights a sharp decline of 3.18%.

The negative performance of Herawhich fell by 2.16%.

A2A drops by 2.15%.

At the top of the mid-cap stocks ranking from Milan, Danieli (+3.43%), Intercos (+3.06%), Saras (+2.81%) e Caltagirone SpA (+1.59%).

The steepest declines, however, occur at MARRwhich continues the session with -5.40%.

Heavy Safilowhich marks a decrease of -3.95 percentage points.

Decline decided for OVSwhich marks -3.19%.

Under pressure Antares Visionwith a sharp decline of 2.44%.